Good morning. Here’s what’s happening:

Prices: As Asia's trading time begins with a insignificant emergence successful Bitcoin and dip successful Ether, experts foretell a pre-FOMC marketplace correction, underlining integer assets' resilience amid US regulatory and indebtedness challenges.

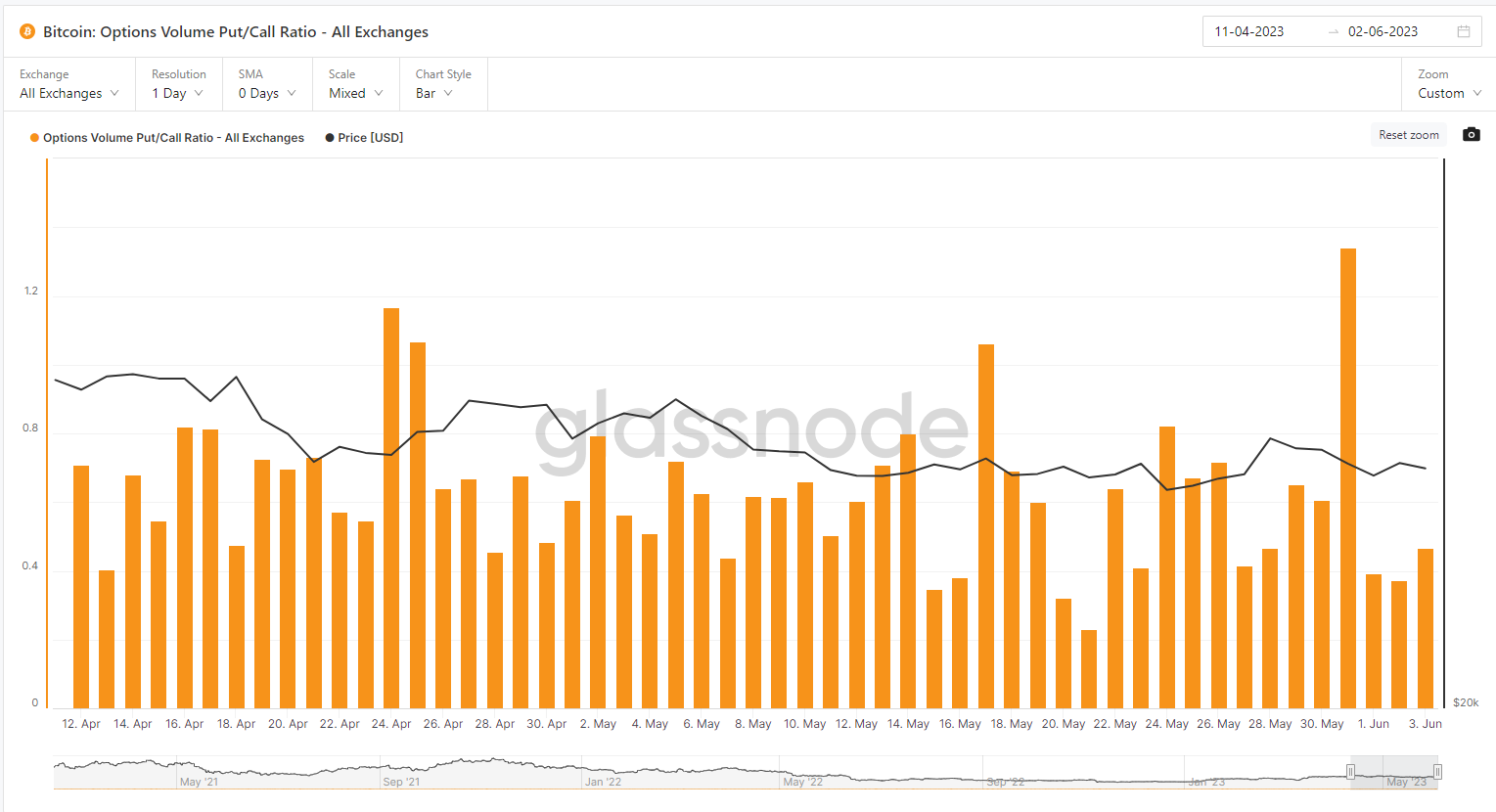

Insights: The diminution successful the bitcoin options put/call ratio suggests that crypto investors are little disquieted than they were successful June arsenic U.S. lawmakers clashed implicit raising the country's indebtedness ceiling.

Bitcoin and Ether Are Still Thriving

As Asia begins its trading day, bitcoin is up 0.1% to $27,109, portion Ether is down slightly to $1,890.

BitBull Capital’s Joe DiPasquale says the taxable this week volition beryllium correction and consolidation earlier the adjacent FOMC gathering minutes are released connected June 14.

“We had been expecting a correction and consolidation betwixt $25K and $27K levels, and that’s what we person been witnessing implicit the past month,” helium told CoinDesk successful a note. “While we haven’t had a large trial of $30K, different effort of the cardinal absorption level would not beryllium surprising.”

Mark Connors, caput of probe for integer plus manager 3iQ, points retired that it's awesome that the integer plus marketplace is inactive thriving contempt the hostile regulatory situation successful the U.S. This is each acknowledgment to a marketplace that continues to beryllium acrophobic astir the unprecedented indebtedness issuance wrong the U.S.

“With equity and indebtedness markets wondering however overmuch the U.S. Treasury's renewed indebtedness issuance volition interaction liquidity and thereby marketplace prices, integer assets are taking matters into their ain hands,” helium wrote to CoinDesk.

Connors writes that contempt 2023's absorption connected Bitcoin's accrued dominance and surging fees amid a challenging U.S regulatory environment, Ethereum's post-merge performance, including an unexpected non-impact of staking 'unlock,' accrued staking demand, and realized deflationary committedness with implicit 250k ETH 'burned,' is garnering marketplace attention.

“So portion the destiny of the $500 trillion equity and indebtedness markets hinges connected the quality of cardinal banks and treasury departments to supply much-needed liquidity, the bellwether integer assets bitcoin and ether are taking attraction of business, and the marketplace is responding – adjacent if institutions and regulators are not,” helium told CoinDesk.

Biggest Gainers

Biggest Losers

Bitcoin Put/Call Ratio Declines Following Recent Debt Deal

Derivatives information shows a caller simplification successful a metric that is prone to emergence erstwhile bearish sentiment increases. The bitcoin options put/call ratio crossed exchanges is presently 0.47, down from 1.34 to statesman successful June.

(Glassnode)

(Glassnode)The purchaser of a enactment has purchased the close to merchantability the plus astatine a specified price, portion the purchaser of a telephone is purchasing the close to bargain the asset. The narration betwixt the 2 tin bespeak capitalist sentiment, peculiarly erstwhile rising oregon falling to utmost levels

The measurement of purchased puts and calls is measured implicit the astir caller 24 hours, with levels supra 1 signaling bearishness, and levels beneath 1 implying the opposite.

The caller diminution indicates that less traders are looking to acquisition downside extortion against aboriginal terms declines. The spike successful extortion toward the extremity of the anterior month, was apt tied to concerns astir the indebtedness woody precocious agreed to by Democrats and Republicans.

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Bitcoin (BTC) was rising somewhat supra $27,000 aft the U.S. added 339,000 successful May, which was amended than economists' expectations. Coinbase organization caput of probe David Duong shared his crypto markets analysis. Plus, TRON laminitis and Huobi planetary advisor Justin Sun joined "First Mover" to sermon the interaction of Hong Kong's Securities and Futures Commission present accepting applications for crypto trading level licenses. And, Marathon Digital Holdings CEO Fred Thiel reacted to the latest authorities authorities impacting bitcoin miners successful Texas.

DeFi Tokens Rose successful a Turbulent Week, CoinDesk Market Index: Lesser known altcoins had a beardown week arsenic bitcoin and ether wrestled with macroeconomic headwinds.

Marathon Digital Mined 77% More Bitcoin successful May With the Help of Its Software: The spike successful bitcoin mining is apt owed to its mining machines producing astatine higher capableness than April.

Sotheby’s Golden ‘Goose’ Sale and Mercedes Benz Puts NFTs successful Motion: Sotheby’s volition merchantability Dmitri Cherniak's landmark NFT astatine a unrecorded auction this month, portion Mercedes Benz released the 'Maschine' and Nike teamed up with EA Sports.

Coinbase Derivatives Exchange to Offer Institutional Bitcoin and Ether Futures: These products travel connected the backmost of the nano futures that were launched past year.

Credit Suisse, Deutsche Bank-Backed Taurus Deploys connected Polygon Blockchain: The Swiss steadfast aims to let fiscal institutions and corporates to contented tokenized assets connected the Ethereum furniture 2 network.

Edited by James Rubin.

11 months ago

335

11 months ago

335

English (US)

English (US)