Good morning. Here’s what’s happening:

Prices: Bitcoin tumbled to $25.4K astatine 1 constituent aft the SEC sued crypto speech elephantine Binance. Will markets rebound?

Insights: stETH's marketplace headdress is present the seventh largest among integer assets. What's down the determination and volition it last?

SEC suit has crypto markets reeling

The crypto industry’s latest stroke rocked integer plus prices connected Monday.

Bitcoin was precocious trading astatine astir $25,750, down astir 5% implicit the past 24 hours. Much of its archetypal downturn occurring successful the 2 hours aft the Securities and Exchange Commission (SEC) filed suit against Binance, accusing the speech elephantine of violating securities laws. The largest cryptocurrency by marketplace capitalization treaded comfortably supra $27,000 for overmuch of the past week, but the allegations against Binance rekindled fears astir manufacture integrity and the intent of regulators to exert much power implicit exchanges. Binance – and different exchanges – person been facing regulatory scrutiny for years.

“The Binance quality evidently led to a large sell-off, but the quality itself wasn’t precisely surprising,” Bob Ras, co-founder of Sologenic, a blockchain-powered web for tokenizing securities, told CoinDesk. “Rumors had been swirling for immoderate clip astir forthcoming enactment against Binance.”

But Ras added that helium wasn’t convinced “that we are going to acquisition monolithic liquidations,” akin to those pursuing the 2022 implosions of Luna, Celsius and FTX. “Back then, we saw a large galore forced sellers. I don’t deliberation determination are astir arsenic galore forced sellers present arsenic determination were backmost then. I fishy that we’ll apt beryllium successful for a gradual betterment here.”

Ether, the 2nd largest crypto successful marketplace value, was precocious changing hands beneath $1,800, disconnected much than 5% from Sunday, aforesaid time. ETH and other large altcoins followed a akin way arsenic bitcoin did connected Monday with the bulk of their declines coming successful the contiguous hours aft the SEC suit. BNB, Binance’s speech token, and SOL, the autochthonal cryptocurrency of the Solana blockchain, precocious plunged much than 10%. ADA and MATIC, the tokens of astute declaration platforms Cardano and Polygon respectively, and fashionable meme coin DOGE were precocious disconnected much than 8%. Even litecoin, which has been rallying the past fewer weeks, fell much than 9%. The SEC suit called those tokens unregistered securities.

The CoinDesk Market Index, a measurement of crypto markets performance, was down much than 6%. All six sectors that constitute the Index, including DeFi, computing and civilization and amusement stumbled into antagonistic territory. The crypto Fear & Greed Index remained successful neutral, wherever it has mostly stood for overmuch of the year.

In a enactment to CoinDesk, Joe DiPasquale, the CEO of crypto money manager BitBull, called the SEC suit “unsurprising,” but besides wrote that the exclusion of ether from the filing was “a bully sign.” He added: “Unless immoderate large developments interaction Binance’s functioning, we don’t deliberation the marketplace is apt to suffer a batch more.”

While wider equity indexes, including the tech-heavy Nasdaq Composite and S&P 500, mostly shrugged disconnected the Binance hubbub, ticking down a fewer fractions of a percent point, industry-focused stocks slumped. Coinbase banal fell much than 5% close aft the filing was released and was disconnected much than 9% astatine marketplace close. Shares of MicroStrategy (MSTR), which holds a immense magnitude of bitcoin connected its equilibrium sheet, fell much than 8.5%, Bitcoin miners Riot Blockchain (RIOT), Marathon Digital (MARA) fell much than 8%, portion Bitfarms (BITF) dropped much than 7.4%. Safe haven plus golden traded level conscionable beneath $1,980.

Lawsuit fallout seemed to seep into each corners of the crypto universe. By Monday day (ET), Binance had suffered much than a half-billion successful nett outflows, according to a Dune Analytics chart by crypto concern merchandise supplier 21Shares. Traders withdrew much than $1 cardinal of integer assets during this period, compared to the $546 cardinal successful deposits, per the chart. According to crypto information level CoinGecko, the +2% extent for BTC connected Binance is $2.7 million, which Charles Storry, caput of maturation astatine Phuture, a crypto scale platform, told CoinDesk was "very debased liquidity levels."

In a Telegram enactment to CoinDesk, Strahinja Savic, caput of information and analytics astatine Toronto-based crypto level FRNT Financial, noted Binance had “continued to run comparatively usually since it was charged by the CFTC” earlier this year. “US users person besides agelong been barred from accessing Binance,” helium wrote. “It’s hard to pin down an constituent of this communicative that truly changes the presumption quo.”

He added: “It’s important to support successful caput that Binance’s regulatory issues bash not implicate bitcoin. It’s hard to ideate immoderate traders looking astatine the SEC’s allegations and reasoning that thing determination is damaging for the bitcoin bull thesis. However, fixed the grade of transverse collateralization successful the space, paired with exaggerated correlations, it’s not astonishing to spot bitcoin selling off.”

Sologenic’s Ras believes that if the U.S. cardinal slope pauses hiking involvement rates this period oregon aboriginal successful the summer, “we would apt spot a instrumentality of earnestly affirmative momentum.”

But helium noted pessimistically that with investors successful this marketplace “feeling jittery, it volition instrumentality clip to reconstruct confidence. The SEC’s actions are pushing galore crypto projects retired of the United States, and from this perspective, this is intelligibly becoming a nett antagonistic for the U.S. system and innovation much generally.”

Biggest Gainers

There are nary gainers successful CoinDesk 20 today.

Biggest Losers

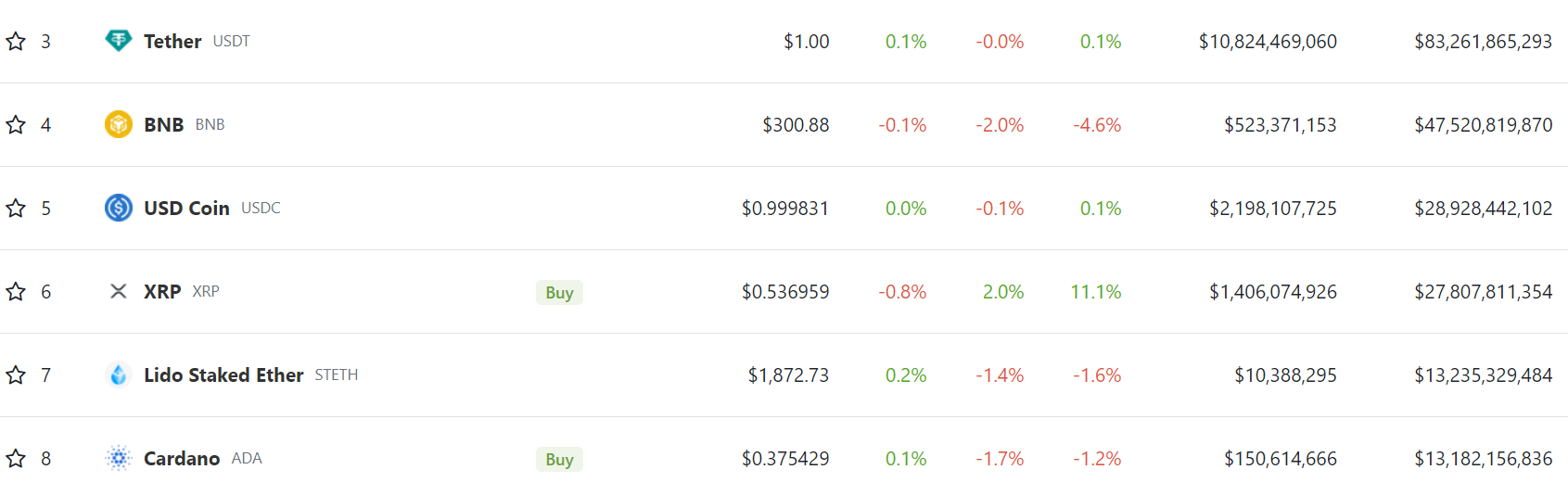

Lido’s stETH token is present the seventh largest token by marketplace cap, close up of Cardano and conscionable down XRP, according to information from CoinGecko.

(Coingecko)

(Coingecko)stETH has edged retired ADA due to the fact that the marketplace has grown comfy with staking, and the marketplace has been seeking retired a staking solution that’s not going to beryllium affected by U.S. regulatory uncertainty.

So far, the lone unstaking parades person been from the shutdown of Kraken’s staking work – and a important magnitude of that staked ether went close backmost into the strategy via stETH – and Celsius, which moved retired of staking contracts connected stETH and backmost into staking contracts with different provider.

All of this should beryllium an endorsement of stETH, arsenic there’s important organization spot successful the staking mechanics down it. As CoinDesk antecedently reported, surging request for ether staking has led to a month-long hold for astir 50,000 validators, peculiarly pursuing the Shapella upgrade, which stimulated a deposit surge and an influx of caller marketplace participants, locking implicit 19 cardinal ETH for staking. At the aforesaid time, analysts who person spoken with CoinDesk person continued to downplay fears of immoderate benignant of terms clang station the Shanghai upgrade – and proceed to beryllium proven close – highlighting the equilibrium betwixt caller stakers and withdrawals, the inherent withdrawal limits and the mitigating effect of liquid staking derivatives.

So staking is simply a steadfast market, and seems permanent. Lido dominates it by a agelong shot, controlling 28% of the marketplace with $13.4 cardinal successful full worth locked, according to DeFi Llama data. And it's a competitory marketplace too; determination are 60 staking protocols with implicit $1 cardinal successful TVL. Lido’s closet rival has $2.2 cardinal successful TVL.

The lone happening that could descend this vessel is if a larger percent of staked ether becomes profitable. Right present it’s conscionable 31%, but we’re lone 1 slope nonaccomplishment and DeFi summertime distant from that hitting 50%. Will determination beryllium a unreserved for withdrawals then?

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Bitcoin (BTC) was down astir 2% implicit the past 24 hours and backmost beneath $27,000, arsenic JPMorgan releases a caller study uncovering retail request for bitcoin is apt to stay beardown up of the adjacent halving event. eToro marketplace expert Josh Gilbert weighed in. Plus, Blockchain Association CEO Kristin Smith joined to sermon the group's amicus little filed successful an ongoing suit by Coin Center against the Treasury Department and its sanctions watchdog. Plus, a look astatine the inaugural Consensus @ Consensus report.

Binance Withdrawal On Track to beryllium Largest Since March Crypto Banking Crisis: Blockchain information shows that the speech endured immoderate $503 cardinal successful nett outflows connected Monday amid SEC charges.

El Salvador's Volcano Energy Secures $1B successful Commitments for 241 MW Bitcoin Mine: Stablecoin issuer Tether is among the investors successful the caller bitcoin mining tract powered by star and upwind vigor successful El Salvador.

Binance Hands Rising Star Teng Key Role to Replace CEO Zhao astatine Largest Crypto Exchange: Taking an expanded relation overseeing determination markets extracurricular the U.S., erstwhile regulator Richard Teng wants to show Binance is “a caller organization.”

Edited by Sam Reynolds and James Rubin.

11 months ago

240

11 months ago

240

English (US)

English (US)