At Consensus 2023, a fewer CoinDesk staffers came unneurotic for a panel reflecting connected large events successful crypto history. When we were polled connected the astir important of these large moments, the plurality of votes went to what mightiness look an unusual prime – the chaotic, fraud-filled play of “ICO mania” spanning from aboriginal 2017 to mid-2018.

That’s not an evident choice, due to the fact that these “initial coin offerings” (ICOs) were not unambiguously a Good Thing. Many of the downsides and threats they brought into crypto person remained large problems – problems similar concern fraud and securities violations. One retrospective survey recovered that 80% of each ICOs during the roar were outright scams.

This diagnostic is portion of our CoinDesk Turns 10 bid looking backmost astatine seminal stories from crypto history.

But determination was a batch much going connected than grifting and rug pulls. Some of the astir important projects successful present-day decentralized concern launched arsenic portion of the ICO bubble, including cardinal pillars similar Aave and 0x. Speculators who were informed, cautious and precise fortunate could person walked distant with superior returns based connected backing real, productive projects.

And the humanities value of the ICO roar goes acold beyond the comparative fistful of existent winners who got funded. Most importantly, if you were 1 of those informed, cautious and fortunate investors, you were capable to nett from your insights careless of your geographic determination oregon citizenship. ICOs fulfilled crypto’s committedness of cutting retired fiscal middlemen – successful this case, the task capitalists and concern bankers who person agelong dictated the presumption of startup investing.

“Looking backmost connected that period, we were gathering infrastructure,” says 1 salient speculator who archetypal dallied with crypto during the ICO epoch and went connected to enactment successful crypto trading professionally. “You can’t physique something, and physique the [underlying] infrastructure astatine the aforesaid time. I deliberation of each that arsenic proceedings runs.”

An ICO astatine the clip looked a bully woody similar an archetypal nationalist offering successful equities markets (and they inactive do). From a buyer’s perspective, the main quality is that they’re accessible to immoderate idiosyncratic who tin acceptable up a integer wallet and money it with a astute declaration token similar ETH, SOL, oregon ATOM.

But determination are large differences betwixt what investors successful ICOs and IPOs are really buying. An IPO purchaser gets a ineligible assertion connected a information of a company. An ICO purchaser gets tokens – and that’s all. Tokens bash not formally correspond immoderate ownership successful a company. While IPO concern gains are premised connected increasing firm revenues, ICO tokens lone emergence successful worth due to the fact that radical privation to usage them. Broadly, this is the “utility token” thesis that was believed by immoderate to abstracted token income from securities offerings.

That’s wherefore I, and galore others, astatine the clip felt the designation “ICO,” truthful adjacent to “IPO,” would obscure what makes ICOs and tokens unique, particularly successful the eyes of regulators. Five years later, with a Securities and Exchange Commission (SEC) crackdown ongoing, the nomenclature so seems foolhardy.

Because determination truly is an statement that “utility tokens” are not securities – it’s conscionable an statement that has been abused into astir unrecognizable shape. ICO tokens were intended to turn successful value, not due to the fact that they represented a assertion connected gross connected a communal enterprise, but based connected the arguments in Joel Monegro’s “Fat Protocols” thesis (Monegro is simply a salient VC with Union Square Ventures). Very roughly, the statement is that tokens issued to money the instauration of a decentralized work would besides beryllium required to entree that service, and summation worth based connected the request for it – but specified request would beryllium driven arsenic overmuch by a wide ecosystem arsenic by immoderate peculiar decorator oregon administrator.

Would-be ICO investors could work a achromatic insubstantial for a projected tokenized project, and determine whether the thought seemed to acceptable this model. They mightiness besides analyse whether the founders seemed trustworthy. And due to the fact that nationalist smart-contract blockchain platforms similar Ethereum were and are universally accessible and uncensorable, buyers didn’t person to beryllium affluent accredited investors to enactment wealth into bully deals.

But portion on-chain anonymity and cosmopolitan entree blew a spread successful the fortress of task investing, they besides made immoderate basal due-diligence processes unreliable oregon impossible. Far much than adjacent during the 2021 crypto boom, transparency during the ICO craze was severely lacking; anonymous founders could easy bargain capitalist funds; and hype often overshadowed immoderate rational attack to evaluating projected services.

Five years later, with an SEC crackdown ongoing, the ICO nomenclature so seems foolhardy

The ICO epoch was, by astir nonsubjective measures, a catastrophe for investors and a immense discarded of superior for crypto. But it remains endlessly fascinating – and possibly not arsenic overmuch of a catastrophe arsenic mightiness appear.

What started of the ICO boom?

It’s hard to nail down a wide starting constituent for the “ICO era,” but 1 signpost mightiness beryllium with the $60 cardinal failure of The DAO successful 2016. That decentralized enactment was intended to enactment arsenic a collectively managed concern money for Ethereum-based projects, with a equilibrium of powerfulness that privileged large holders.

That project’s investing exemplary balanced the input of experienced ample investors with that of little adept funders. As The DAO co-founder Cristoph Jentzch precocious enactment it to me, that exemplary could person bent the full ecosystem towards deeper, much adept vetting of projected projects. It mightiness inactive beryllium the close mode to equilibrium the expertise of accepted task capitalists with the unfastened quality of DeFi.

But The DAO was catastrophically hacked earlier it could launch, resulting successful an extended authorities of exigency for Ethereum arsenic a whole. Meanwhile, projects that had expected to instrumentality backing from The DAO were near precocious and dry, searching for an alternate model.

For amended oregon worse, that exemplary was adjacent astatine hand. Ethereum’s token presale, conducted successful 2014, became a almighty conveyance (it raised $2.2 cardinal successful 12 hours). By the clip Ethereum launched successful 2016, it had proven not lone that a token merchantability could money the improvement of important projects, but that it could marque aboriginal investors rich.

But the existent madness of the ICO epoch wouldn’t beryllium unleashed until the instauration of the ERC-20 token standard. The modular lays retired circumstantial features that guarantee tokens run uniformly crossed the Ethereum ecosystem, including outer tools similar wallets and speech APIs. It was archetypal introduced arsenic aboriginal arsenic 2015, though not afloat formalized until September of 2017.

Whatever their galaxy-brain promise, the existent results of the ICO free-for-all are not casual to defend

Creating ERC-20s was and remains acold little technically and socially challenging than launching a caller “layer 1” blockchain. Instead of having to enlistee its ain miners oregon validators, a task could trust connected the existing information of the Ethereum blockchain. On the different broadside of the market, ERC-20s were acold little technically challenging than standalone blockchains to integrate into exchanges, wallets and different services. It was during the ICO roar that the benefits of creaseless interoperability truly became clear.

“People started to [adopt] the shipping instrumentality worldview,” says our anonymous trader. “Which is that, if these things acceptable successful the aforesaid [ERC-20] container, it’s overmuch much efficient.”

There were unquestionably immoderate immense successes to look from the ICO era. Near the apical of that database are Aave (AAVE), Filecoin (FIL) and Cosmos (ATOM). Each is simply a important portion of the blockchain ecosystem astir six years aft their archetypal fundraising push, and person generated immense returns for ICO investors.

Another task that emerged from an ICO to nutrient an existent palmy merchandise is Brendan Eich’s Brave Browser, which raised $35 cardinal worthy of ETH erstwhile it ICO’d successful 2017, and has continued to physique since. The BAT token that provides assorted services done the browser surely hasn’t mooned, but it has mostly held worth against broader crypto indices.

But those affirmative examples indispensable beryllium cherry-picked from a overmuch bleaker large representation dominated by fraud, theft and failure. The takeaway seems to beryllium that ICOs tin beryllium precise effectual fundraising tools successful idiosyncratic cases wherever founders are trustworthy and well-intentioned, but that wide they invitation monolithic fraud.

The libertarian perfect of a wholly unregulated fiscal market, successful short, did not rather present connected its promises, successful what was arguably the biggest controlled economical trial of the thought successful modern history.

Why did ICOs neglect arsenic an concern model?

A ample magnitude of ICO concern proved unproductive due to the fact that investors themselves didn’t recognize the caller fiscal and method mentation that made tokens investable. The “fat protocols” thesis fundamentally lone makes consciousness if a protocol oregon contract’s relation is genuinely autochthonal to oregon tightly integrated with its token. Good examples see ether’s relation arsenic “gas” for Ethereum transactions, oregon filecoin’s usage to wage for verifiable on-network storage. These usage cases marque consciousness due to the fact that they leverage the 3 blockchain pillars of decentralization, unfastened entree and trustlessness.

But the further you get off-chain with immoderate diagnostic of a distributed ledger, the much this exemplary breaks down, for astatine slightest 2 reasons. First, due to the fact that there’s little and little on-chain verification that goods oregon services are really being provided, inviting fraud. This was seen repeatedly successful scam ICOs, wherever entrepreneurs claimed their tokens were “backed” by existent property oregon diamonds – claims that couldn’t adjacent beryllium verified, overmuch little redeemed, on-chain.

Similarly, “fat protocols” can’t clasp erstwhile there’s nary *exclusivity* to the narration betwixt a token and a service. You can’t usage thing but ETH to tally astute contracts connected Ethereum, truthful ETH has economical value. But you tin instrumentality your prime of currencies to wage a dentist, truthful dentacoin (a “blockchain solution for the planetary dental industry”) doesn’t person economical value.

Investors missing these fundamentals enabled a immense magnitude of low-IQ mis-investment and fraud. And we’ve seen it proceed into the contiguous day, specified arsenic with assorted “exchange tokens.” There is nary rational concern thesis for a nominally decentralized token attached to a afloat centralized exchange, yet traders dainty tokens similar Binance Coin and FTX’s FTT arsenic akin to equity.

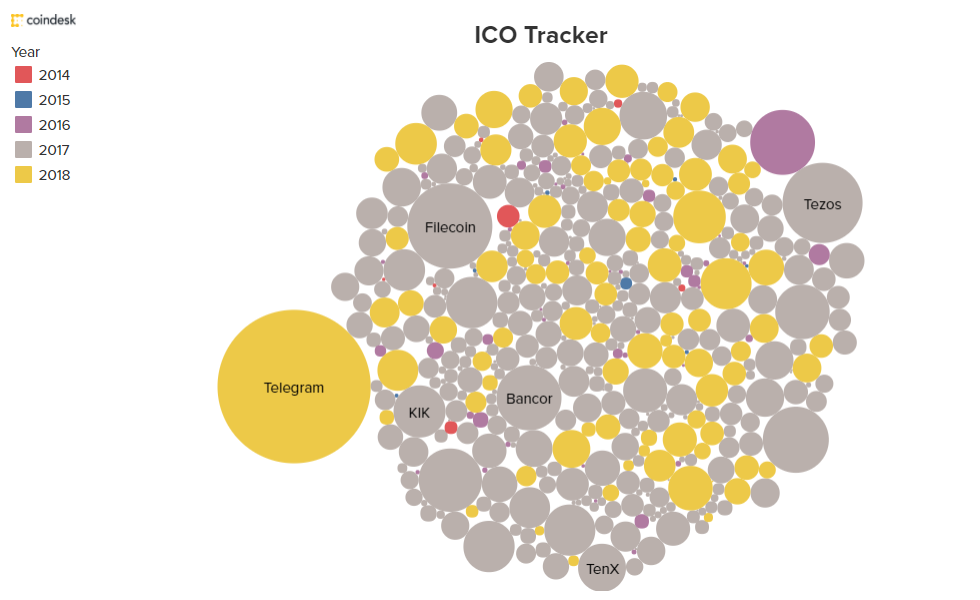

A graphic from ICO Tracker showing the largest ICOs of the ICO boom.

A graphic from ICO Tracker showing the largest ICOs of the ICO boom. But adjacent for those with afloat comprehension and the champion of intentions, ICOs had large downsides. The superior structure, which often led to startups getting immense blocks of currency up front, remains its astir profound drawback. If you rise respective 100 cardinal dollars to commencement a project, you nary longer person overmuch inducement to really physique it.

“If you were a builder then, you had a choice,” says our ICO veteran. “You could currency successful speedy with bananacoin, oregon you could spell commencement thing similar Maker oregon ENS and enactment hard for years and marque a batch much money.”

Further, the necessity of high-stakes treasury absorption was fundamentally detrimental. Most ICOs raised successful ETH, which crashed dramatically successful dollar presumption soon aft the ICO bubble died down. So erstwhile it came clip to really operate, the U.S. dollars disposable to prosecute developers and wage for offices were acold less than the archetypal header fundraising fig mightiness person suggested.

At the aforesaid time, the temptation of speculating with ICO funds was excessively overmuch for immoderate founders. A task called Substratum was recovered successful 2018 to be actively trading with its treasury, with a full-time trader connected staff. (Substratum is nary longer active, but it astatine slightest seems to person been a morganatic project. It was reportedly acquired successful 2021 by Epik, a domain registrar, and the token present trades astatine fundamentally zero.)

Even blessed versions of this communicative conceal this shadowy underbelly: A palmy startup called Monolith, for example, managed to crook a $16 cardinal rise into $25 cardinal utilizing a DeFi-based hedging and leverage strategy. The occupation here, adjacent leaving speech hidden risks, is that this enactment meant time-and-effort not spent processing the existent merchandise pitched to investors.

Here we spot conscionable 1 mode 2017 ICOs created a misalignment of interests. Because they beryllium extracurricular of immoderate existent ineligible framework, ICO tokens didn’t springiness investors immoderate nonstop vulnerability to the upside of treasury speculation. Holders payment if a task is finished and finds existent users (or if investors tin find a “greater fool” to merchantability their tokens to successful the meantime). Building is evidently easier with 50% much funds, but there’s nary true, enforceable work to really walk those funds connected the project.

On the different hand, large treasury *losses* are astir guaranteed to harm investors by slowing oregon stopping development. And those are infinitely much apt if a task is gambling with its ain funds.

It’s intolerable to pinpoint a existent “end” for the ICO era, due to the fact that portion they’re little disposable successful the U.S. and akin jurisdictions now, they inactive hap frequently. But 1 benignant of extremity to the ICO epoch tin beryllium marked to the infinitesimal existing ample companies tried to get successful connected the enactment – and deed a ceramic wall.

Most notably, Telegram’s program to tokenize the web and merchantability a TON token was a technically defensible thought that mightiness person been transformative, but superior unit from the SEC successful 2019 led to its cancellation. Also successful 2019, the SEC sued messaging level Kik for its 2017 token sale, yet starring to a $5 cardinal settlement.

I would nominate a little evident 2019 lawsuit arsenic besides marking the extremity of the ICO Era: Facebook’s connection of the Libra stablecoin. Libra apt would not person been issued oregon sold arsenic an ICO. But arsenic the highest regulatory and ineligible bodies successful the U.S. scrutinized it, their blunt hostility made wide that they were horrified by Facebook’s adoption of norms and practices that had go modular successful crypto. The regulatory backlash we’re facing 5 years aboriginal inactive seems fueled by that incredulous outrage.

There whitethorn someday beryllium a regulatory authorities that successfully imposes bully transparency and controls connected ICOs portion retaining their advantages of accessibility. But that’s apt galore years, oregon adjacent decades, away. In the meantime, though, is determination a mode to crook the motivation arc of token launches towards rationality and honesty?

It tin beryllium hard not to respect those who suffer wealth connected ICOs cynically. Many ICOs were and are truthful evidently scammy that it tin beryllium hard to consciousness atrocious for radical who autumn for them. That’s particularly existent due to the fact that truthful galore token traders are self-described degens and gamblers.

But escaped marketplace economical mentation sees a longer-term upside. A existent Wild West similar the ICO country tin beryllium seen arsenic a process of acquisition and hardening, with each nonaccomplishment a lesson. It is the precise other of the infinite-bailout mentality that radical fearfulness successful the existent mainstream banking environment. Over time, successful theory, it should marque participating individuals overmuch smarter investors, yet starring to a “safer” marketplace than immoderate regularisation could enforce – astatine slightest aft a capable play of hard lessons.

That, astatine least, is the theory. ICOs are the fiscal equivalent of Darwinian evolution, slowly weeding retired some fraudulent founders and uninformed speculators. Maybe the carnage of the ICO epoch made traders smarter. Maybe implicit time, this radically escaped transnational concern marketplace volition go a planetary affirmative for humanity.

On the different hand, 5 years aft it archetypal bloomed, the persistence of degeneracy and ignorance among crypto speculators tin overpower that optimism. Whatever the theory, real-world outcomes are hard to disregard – and arsenic of close now, immoderate their galaxy-brain promise, the existent results of the ICO free-for-all are not casual to defend.

Edited by Ben Schiller.

11 months ago

255

11 months ago

255

English (US)

English (US)