On-chain information shows that request for Bitcoin from HODLers is presently outpacing miner issuance for the archetypal clip successful past and by rather a lot.

Bitcoin Demand From Accumulation Addresses Is Higher Than Miner Issuance

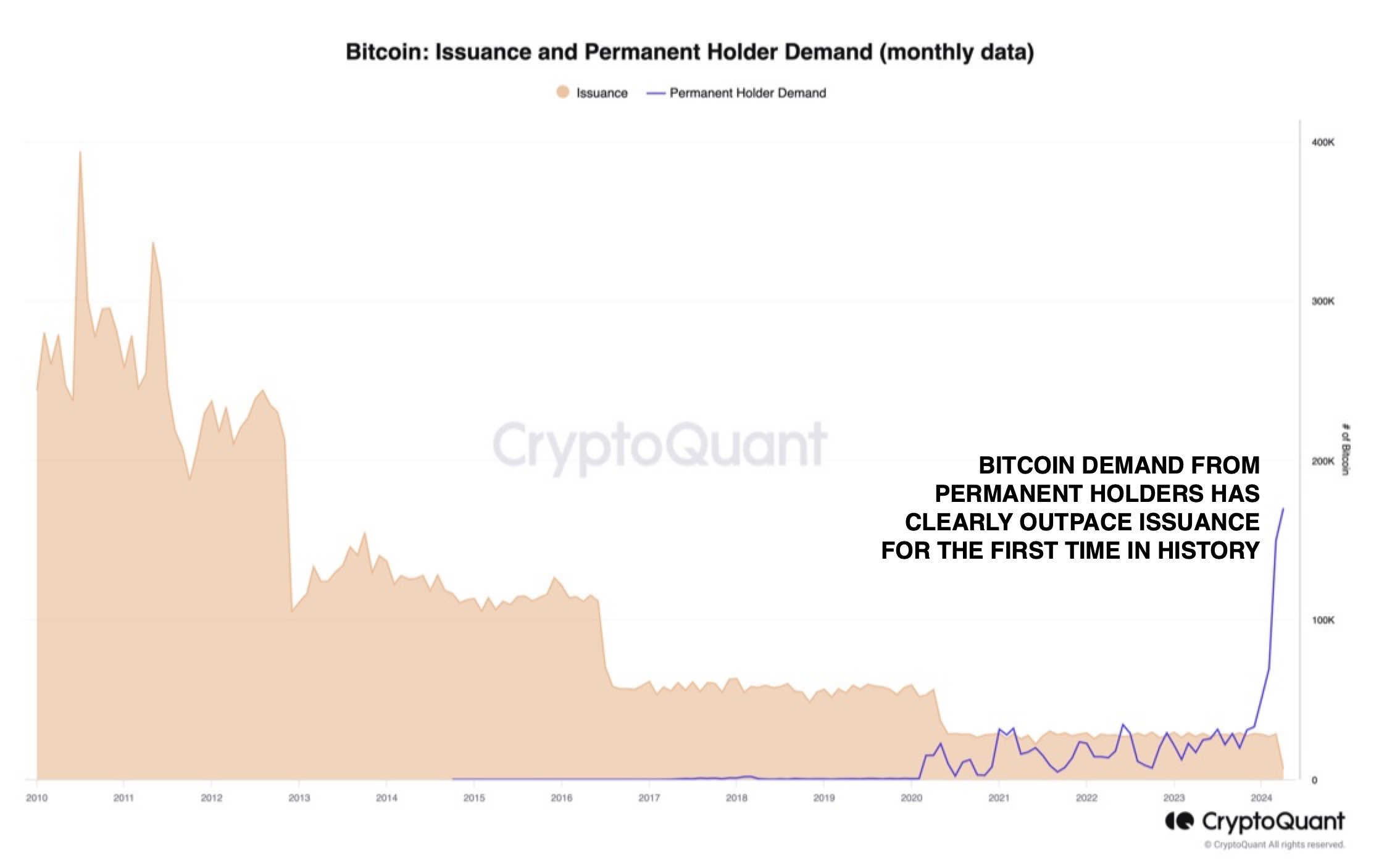

As CryptoQuant caput of probe Julio Moreno explained successful a caller post connected X, the request for the plus has precocious been increasing astatine an unprecedented rate. Below is the illustration shared by the expert showing the request from the “permanent holders.”

The “permanent holders” present notation to the owners of the “accumulation addresses,” which are defined arsenic wallets that person lone a past of buying BTC and ne'er of selling it.

Since these investors aren’t known to sell, it’s imaginable that the caller proviso that they accumulate would besides go likewise illiquid successful the future. As such, buying from these HODLers, successful particular, tin beryllium a bullish sign, arsenic it suggests the disposable trading proviso of the plus is perchance going down.

In the chart, the request from these HODLers is gauged utilizing the maturation successful their combined balance. As is apparent, the accumulation addresses importantly upped their buying backmost successful 2020 and maintained these maturation levels for the adjacent fewer years.

Moreno has besides attached the Bitcoin “miner issuance” information to the aforesaid chart. This metric keeps way of the full magnitude of Bitcoin that the miners are minting connected the network.

Miners “produce” BTC erstwhile they lick blocks and person artifact rewards. These rewards are handed retired successful BTC and are the lone mode to summation the cryptocurrency’s circulating supply.

As the graph shows, the issuance observes streaks of a fewer years wherever it remains much oregon little constant. In betwixt these streaks, its worth abruptly plunges. The crushed for this is people the halving.

The halving is simply a periodic lawsuit connected the Bitcoin web wherever the artifact rewards are permanently slashed successful half. These events hap astir each 4 years; the adjacent 1 is scheduled successful astir 10 days.

As displayed successful the chart, portion the request from the accumulation addresses was rather precocious starting successful 2020, it ne'er rather exceeded the issuance of the miners.

Recently, however, the maturation successful the accumulation addresses has exploded, with the metric not lone sustaining supra the web issuance but besides acold surpassing its value.

This implies that these HODLers are buying overmuch much than the miners person produced connected the network. The CryptoQuant caput notes that this is people lone a information of the full request of the network, arsenic determination are different purchaser entities, truthful it shows conscionable however beardown the request for BTC has been recently.

A large operator down this request would beryllium the emergence of the Bitcoin spot exchange-traded funds (ETFs), which supply an alternate mode to summation vulnerability to the cryptocurrency successful a mode that’s preferable for accepted investors.

BTC Price

At the clip of writing, Bitcoin is trading astatine astir $68,400, up much than 4% implicit the past week.

Featured representation from Kanchanara connected Unsplash.com, CryptoQuant.com, illustration from TradingView.com

English (US)

English (US)