Hello! Welcome to different year-end look astatine the satellite of DeFi. As successful 2020, 2021, and 2022, we’ve collated beneath the apical memes of the twelvemonth for 2023, on with 5 charts that assistance explicate the year. It’s been a twelvemonth without euphoria, yet enthusiasm emerged crossed respective cardinal areas. Narrative improvement is cardinal to occurrence successful crypto and DeFi; the memes beneath are intended to item however parts of the manufacture person tried to physique momentum astir ideas, problems, oregon concern opportunities. The charts are snapshots of an manufacture that present has years of marketplace cycles and competitory battles nether its belt, but is inactive creating caller marketplace structures and primitives.

This contented of Dose of DeFi is brought to you by:

Oku makes DEX trading seamless crossed the apical EVM chains. Try it present with 0% fees and precocious analytics. Website & Twitter

The archetypal on-chain AMM Bancor launched successful 2017. This was followed by Uniswap successful 2018, and soon after, impermanent loss was coined to picture the hazard of LPing successful an AMM with crisp (or truly any) terms movements. Tim Roughgarden of Columbia and a16z crypto reframed the problem and rebranded impermanent nonaccomplishment to loss versus rebalancing (LVR). Eliminating impermanent nonaccomplishment seemed similar an impossibility, but reducing LVR feels similar a “challenging but well-defined problem”, in the words of Dan Robinson. New probe besides emerged this twelvemonth from Max Resnick astatine the Special Mechanism Group that illustrated the CEX-DEX arbitrage, which immoderate accidental is liable for 85-90% of each MEV profits.

Minimizing LVR has present go a modus operandi for each DEX designers. Uniswap unveiled its v4, with its halfway conception of hooks giving LPs – oregon much accurately, caller DEX designers – much tools to woody with LVR. This has not yet launched but its code is public. Ambient Finance has a akin conception but launched on-chain without the catchy hook descriptor. It has dynamic fees and hopes to reduce toxic flow. Sorella Labs has yet to merchandise its Angstrom project, but it aims to use a gated liquidity layer built connected Uni v4, with the quality to auction disconnected the close to commercialized with LPs. This is akin to the plan that CoW Swap has researched. All absorption is present connected reducing LVR and incentivizing searchers to enactment connected behalf of LPs.

Learn more:

Ending LP’s losing game: Exploring the Loss-Versus-Rebalancing (LVR) Problem and its Solutions [0xKeyu/Fenbushi].

Will MEV mitigation destruct on-chain liquidity? [Dose of DeFi]

Uniswap v4 and Ambient Finance: Fresh anticipation for passive LPs [Dose of DeFi]

Ethereum is simply a analyzable web of competing ideas and interests. There’s the Ethereum Foundation (EF) and the societal layer, and past there’s exertion developers and users. Becoming aligned with each of these stakeholders has go a spot of a gag successful 2023.

On 1 hand, you person different chains competing with each different to amusement however committed they are to Ethereum, similar Polygon backing Ethereum halfway devs to amusement its zkevm is aligned with Ethereum. On the different hand, immoderate radical accidental they are “unaligned” with Ethereum due to the fact that they disagree with the method absorption the protocol has taken. This group is captious of PBS and the MEV ruling people it has spurred. Some privation faster artifact times, portion others are frustrated with the solo-stakers obsession.

Explore further: Ethereum, to be, oregon not to beryllium (aligned)? [Abdelhamid Bakhta/Starknet].

At a macro level, 2023 was defined by involvement complaint hikes astatine grounds pace. This wreaked havoc astatine determination banks and yet blew up Silicon Valley Bank and tarnished the sterling estimation of the DeFi’s Blue Knight (USDC). It was fitting that during the frantic play earlier the FDIC announced that SVB depositors would beryllium made whole, USDC was considered the broader marketplace terms for an SVB recovery.

USDC is the astir fashionable stablecoin successful DeFi lending protocols, truthful its depegging could person created atrocious indebtedness from mispriced collateral. On Compound, USDC was hardcoded to $1.00, truthful determination was nary hazard of atrocious debt. Since then, Compound released v3, which only uses USDC arsenic its borrowing stablecoin and does not arsenic collateral. Aave, meanwhile, experienced the biggest scare during the USDC depeg. USDC did not driblet beneath $0.85 and frankincense endanger the ample mainnet markets, but Aave v3 with ratio mode (E-Mode) saw immoderate losses. Maker engulfed an other $2 cardinal successful USDC, leaving it adjacent much babelike connected the stablecoin. The lawsuit near specified a sour sensation that it’s pushing Dai to determination distant from the US dollar on a way laid retired successful the Endgame by Maker laminitis Rune Christensen. It has besides onboarded different RWAs to importantly alteration the reliance connected USDC.

Return: Damage control: DeFi lenders and the USDC depeg [Dose of DeFi]

When you archetypal perceive “intents” successful a superior crypto conversation, you astir apt wonderment wherefore determination needs to beryllium a connection for it. But past you spot however the connection has been utilized arsenic a self-descriptor for a swath of caller “intent-based protocols”. Could these beryllium without archetypal the instauration of the intents meme? Was CoW Swap an intent-based protocol erstwhile it launched earlier the meme was popularized? Put connected your tin foil hats everyone.

In reality, the displacement successful idiosyncratic behaviour from 1 wherever an execution way is defined to 1 wherever an extremity end is signaled is subtle but important, and necessitates a connection to picture the caller plan space. Looking ahead, exertion developers volition physique for an intents world, but determination is inactive a batch of statement connected how these intents volition beryllium solved. Front-ends and applications are wherever MEV is leaked, truthful they volition request to travel up with solutions to power their MEV proviso chain.

Background: Intent-based architectures and their risks [Quintus Kilbourn & Georgios Konstantopoulos/Flashbots & Paradigm]

Restaking is 1 of those ideas that is truthful intuitive, you wonderment however it was not thought of before. Put simply, a restaking protocol enables ETH validators to make further output by moving different computational tasks, specified arsenic an oracle. Sreeram Kannan theorized the thought that became Eigenlayer astatine the University of Washington successful 2021, but it was this twelvemonth that the thought genuinely broke done to the mainstream Ethereum conversation. Eigenlayer raised $50m successful March. Its testnet launched successful April and it went unrecorded connected the mainnet successful June, supporting stETH and rETH. Already, $400 cardinal has been staked connected EigenLayer, reaching the headdress for signifier 1 of the mainnet launch, adjacent though determination is nary explicit output promised.

Restaking changes Ethereum successful 2 cardinal ways. First, it offers a credible alternate to projects flirting with the app concatenation exemplary of Cosmos. Cosmos’ entreaty is the quality to easy bootstrap a tiny validator acceptable that does much than conscionable consensus, but really runs logic connected behalf of the application. dYdX has already shown the method advantages successful this attack with their v4. The rising popularity of coprocessors volition besides beryllium a cardinal usage lawsuit for restaking.

Second, it introduces much leverage to Ethereum. This is what Vitalik is talking about erstwhile helium wrote astir not “overloading Ethereum’s consensus”. The aforesaid assets are being rehypothecated to unafraid much and much economical activity. Vitalik’s interest is however a downstream occupation for a heavy restaked protocol mightiness endanger Ethereum’s credible neutrality.

Restaking opens up the plan abstraction for trustless compute but it besides introduces much layers of hazard that indispensable beryllium monitored.

Dig deeper:

Restaking and shared information - the aboriginal of blockchain infrastructure [Felix Lutsch/Chorus One]

After Shapella, a caller dawn for ETH output products [Dose of DeFi]

Restaking Alignment with Vitalik, Sreeram, Tim Beiko, Justin Drake, Dankrad & Jessy [Bankless]

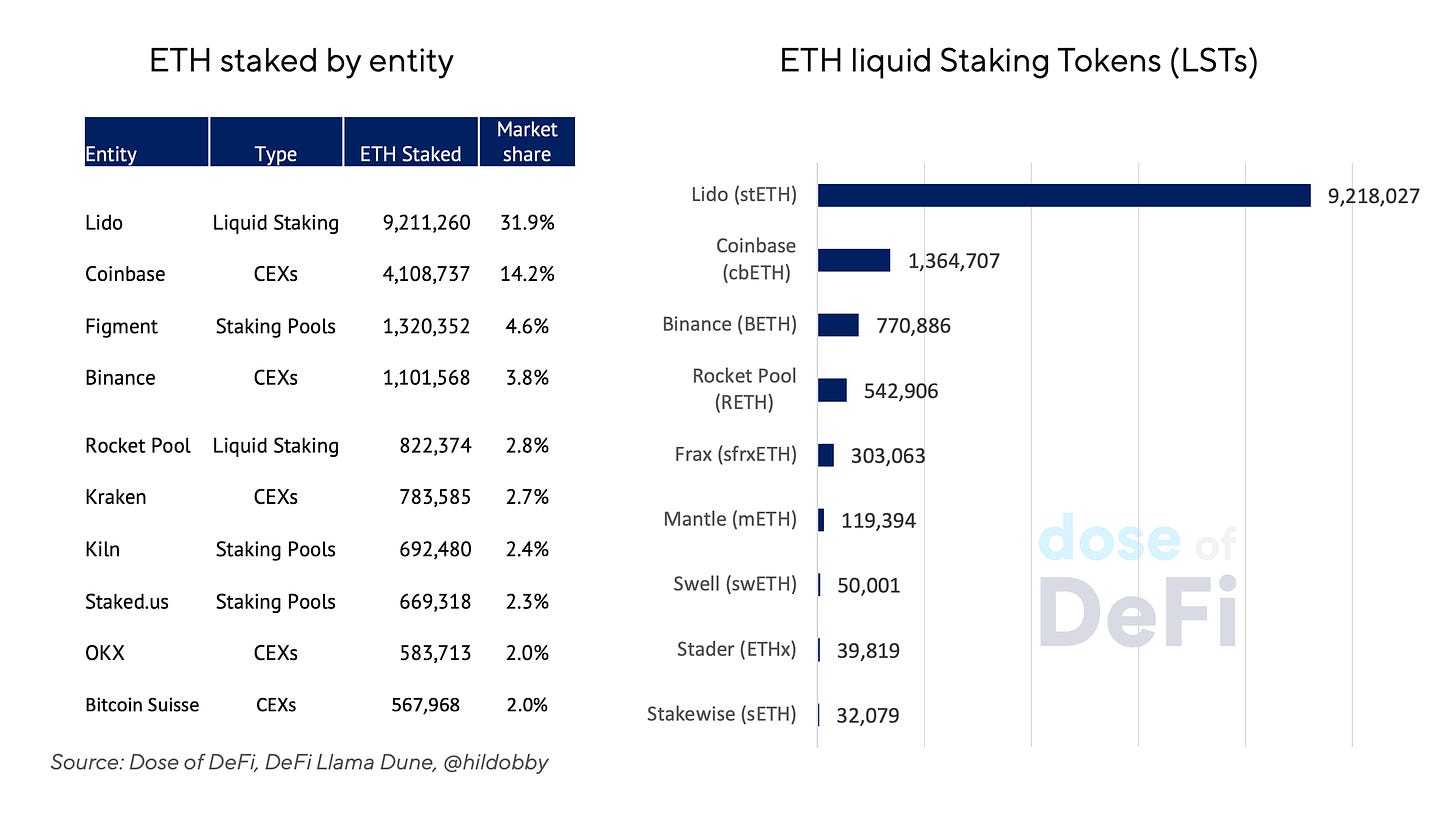

Lido has go possibly the astir important protocol successful DeFi aft it cornered the marketplace connected liquid staking tokens (LST’s) successful 2022. There has been sizeable anxiousness connected the powerfulness that Lido has. It has maintained a large pb connected the LST marketplace with implicit 75% marketplace share, and a sizeable pb successful the wide ETH involvement marketplace hovering astir ~30%. Many successful the ETH assemblage spot keeping Lido beneath the 33% threshold arsenic cardinal to maintaining Ethereum’s decentralization, truthful it is notable that it did not importantly summation its marketplace share, though the wide magnitude of ETH staked accrued by 80% this twelvemonth with ~23% of each ETH staked.

What are the downsides of Lido’s dominance? In their ain words: "The astir important interest is astir apt the validator/operator whitelist. If Lido continues to summation marketplace share, there’s a hazard that LDO holders would beryllium capable to efficaciously find the bulk of the Ethereum validator set. Governance could past shepherd Lido’s operators into moving unneurotic to exploit multi-block MEV, execute profitable re-orgs, and/or censor definite transactions." In February, Lido announced their v2, intended to decentralize the node relation list.

However, amidst these risks, Lido provides a buffer against KYC-ed exchanges dominating the Ethereum validator acceptable (Coinbase is catching up with 15% share). We expect aggravated discussions astir the platform's interaction successful the coming years.

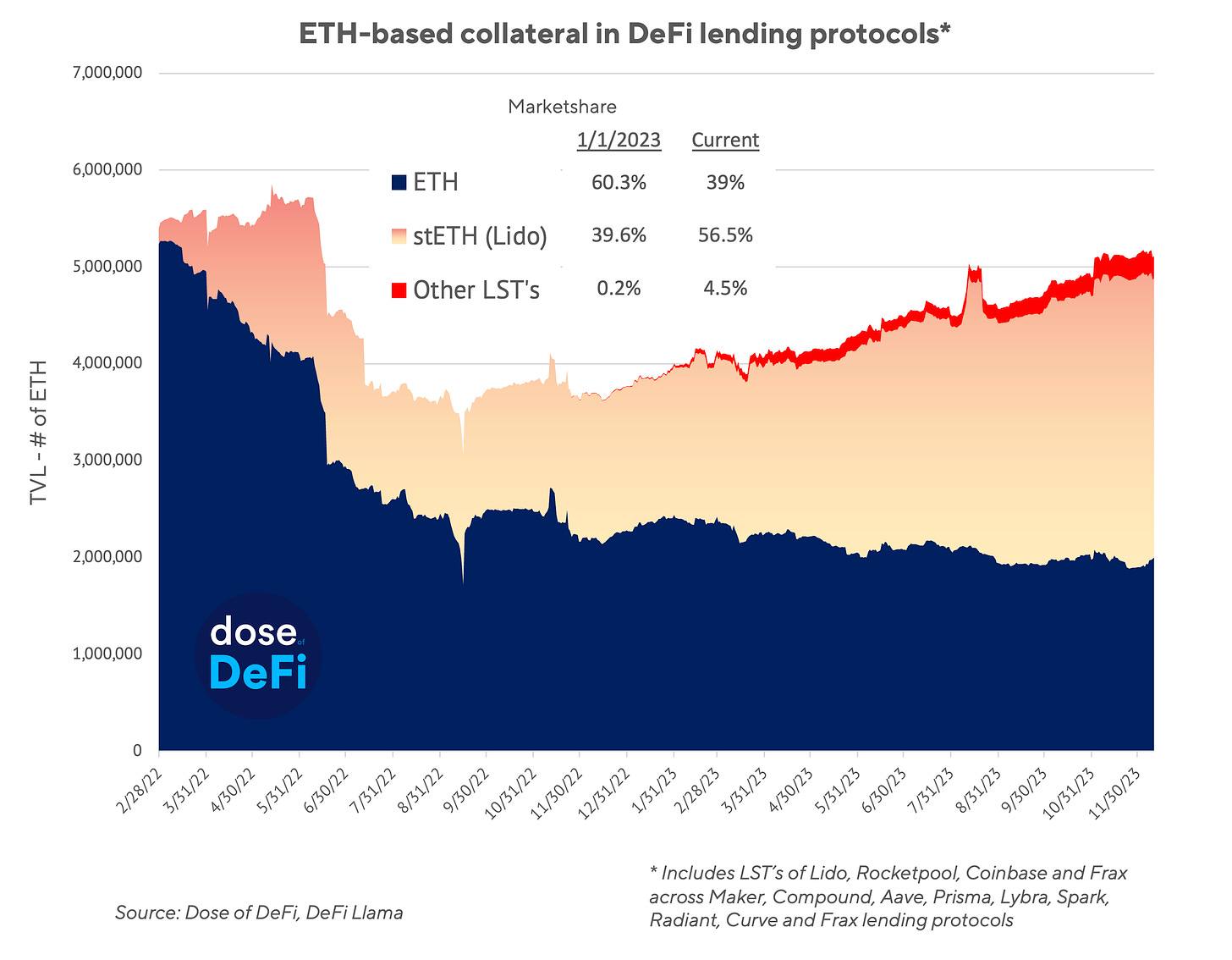

DeFi lending protocols did not unveil caller protocol designs similar their DEX brethren. Instead, they were focused connected diversifying diversifying its collateral base. The astir important alteration of the twelvemonth was the displacement from ETH arsenic the superior root of collateral to LSTs, specifically Lido’s stETH, which present accounts for a staggering 56% of collateral successful large DeFi lending platforms. This explains Lido’s emergence and reinforces its dominance, arsenic its liquidity successful DeFi simply makes it much utile than different LST’s.

Elsewhere successful lending, Real World Assets (RWAs) accrued dramatically, astir notably astatine MakerDAO. Up until USDC’s depeg, astir 50% of Dai was backed by USDC. Maker onboarded astir $2.5bn successful RWA collateral successful the signifier of US Treasury bills, facilitated by BlockTower and Monetalis Clydesdale, which has decreased its reliance connected centralized stablecoins to conscionable nether 9%. Maker besides launched Spark, different lending protocol that forked Aave v3, which experienced accelerated maturation implicit the 2nd fractional of the year.

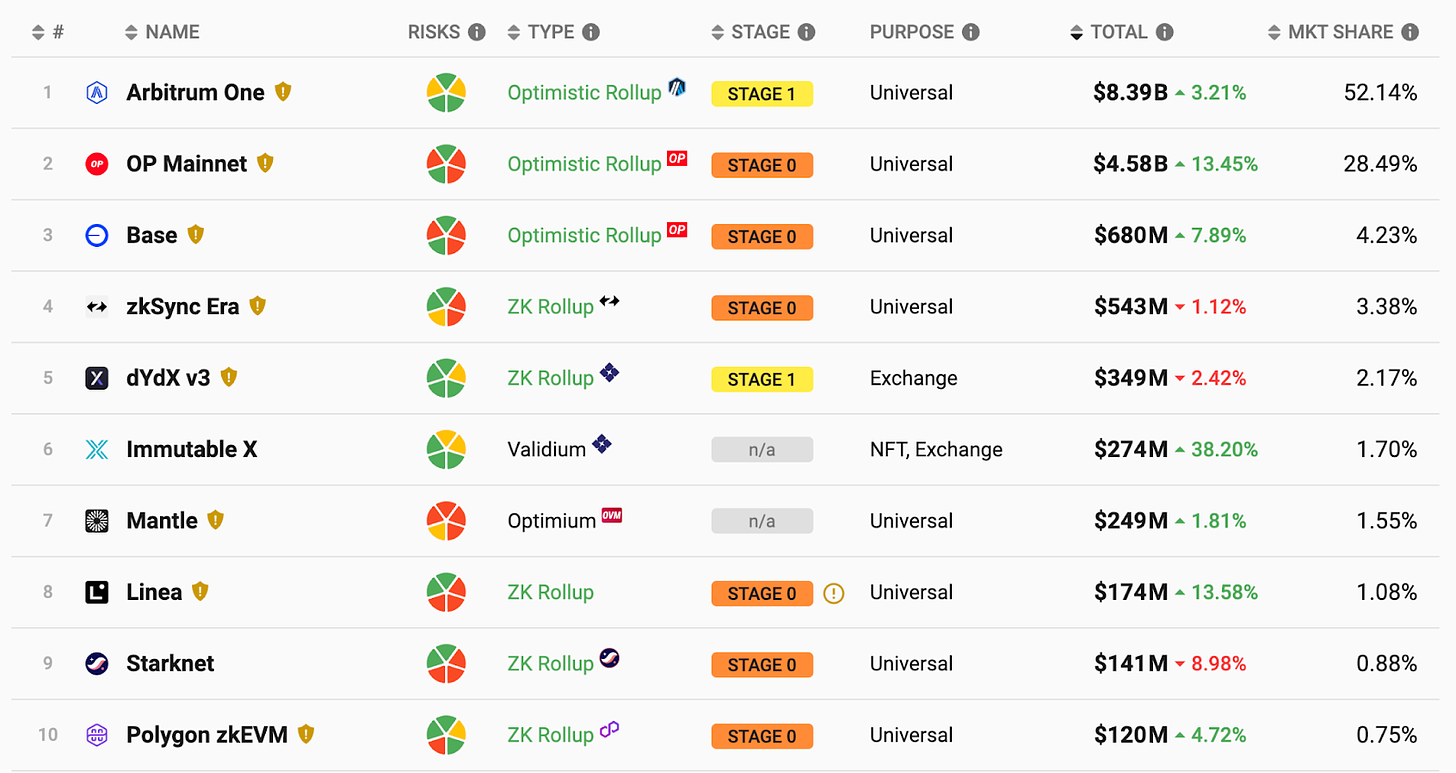

In 2023, rollups emerged arsenic a pivotal unit successful the industry. From the earlier discussions to the proliferation of divers rollup solutions, the assemblage experienced a important surge. Total worth locked (TVL) has shown consistent growth, fostering steadfast contention among ecosystems. Users present person the autonomy to opt for chains offering little transaction costs, which are already beneath Ethereum's rates (though inactive not reaching perfect levels). However, arsenic the idiosyncratic basal expands, transaction batching volition trim costs.

What interests america astir is the diverseness successful the rollup offering (see chart). Optimistic rollups presently dominate. Arbitrum (after launching an airdrop successful 2023) is starring successful TVL, with Optimism following. However, the second is increasing horizontally – Coinbase’s Base concatenation is utilizing Optimism Stack and is a portion of its Superchain. Even though Vitalik predicts the eventual triumph of the ZK technology, ZK-based zkSync, Scroll and Starknet are yet to summation important traction (and yet to motorboat tokens).

Stablecoins person endured the carnivore marketplace rather well, with full worth dilatory decreasing from $140 cardinal astatine the highest of the bull marketplace to $130 cardinal astatine present, importantly little than the 40% diminution successful the full crypto marketplace cap. Despite this, USDT has maintained its enactment position, witnessing maturation successful some implicit worth (from $65 cardinal to $90 billion) and successful marketplace stock (from 48% to 70%). Meanwhile, USDC backed by Circle appeared to beryllium making each the close moves, from person collaboration with regulators, to expanding onto much chains and processing a top-tier bridge. Yet its marketplace stock declined from 31% to 19% successful 2023. The USDC depeg is the astir apt culprit for the decline. Tether's USDT has firmly established itself wrong exchanges and is gaining momentum in South-East Asia and Latin America. Does USDT’s “up only” show amusement america that the stablecoin marketplace yet favors a winner-takes-all scenario?

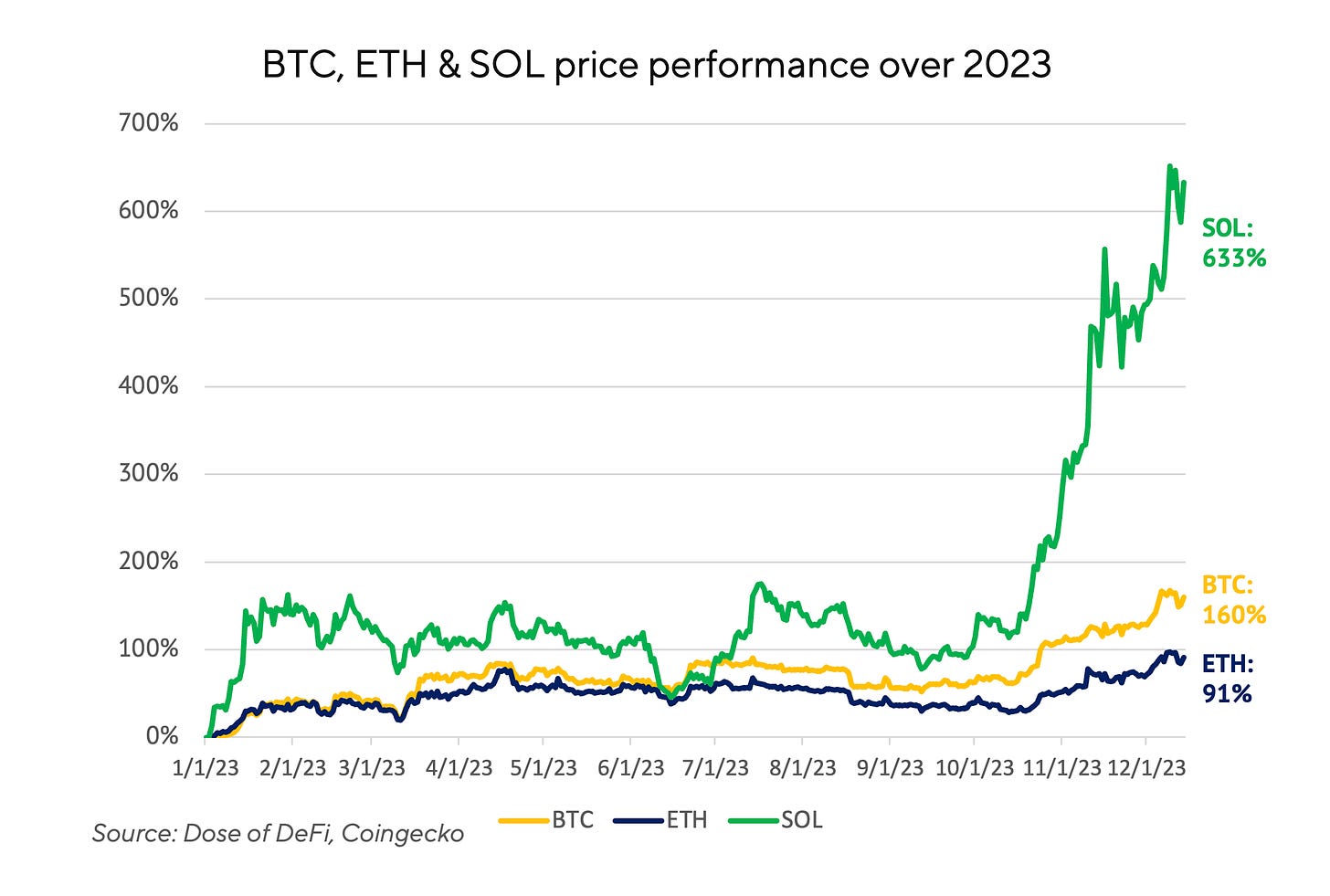

Comparing prices astatine the extremity of the twelvemonth is ever an workout successful the arbitrary but it’s inactive amusive nary the less, particularly comparing however the coins are doing astatine the extremity of 2023 compared to 2022. Who knows if this is the opening of a sustained bull market, but it’s intelligibly enactment immoderate carnal spirits backmost into the industry.

The coins person each gone up, but not astatine the aforesaid pace. Solana is connected an implicit tear, particularly implicit the past 2 months, reminiscent of however ETH outperformed BTC successful 2021. More recently, Solana is starting to spot immoderate uptick successful DeFi activity. BTC, meanwhile, has reminded america to respect the orangish coin. It has specified a unsocial presumption successful the nationalist psyche. It seems immoderate normies person reclaimed the communicative from the maximalists and determination is present worldly really being built connected Bitcoin.

ETH, meanwhile, has lagged behind. It has agelong been the halfway of DeFi, truthful we are intelligibly biased towards it. Two problems bent implicit the ETH narrative: inability to standard and MEV extraction. These are lone problems for Ethereum, due to the fact that it’s the lone blockchain with capable enactment to make these problems successful the archetypal place. An service of researchers and developers are trying to lick these problems now. What’s wide is whether it’s a multichain satellite oregon a modular one, determination volition beryllium not beryllium 1 concatenation to triumph them all.

That’s it! Feedback appreciated. Just deed reply. Written successful Nashville, wherever I’m afloat embracing the vacation season. May I beryllium 1 of the archetypal to say, “Happy New Year!”

Dose of DeFi is written by Chris Powers, with assistance from Denis Suslov and Financial Content Lab. All contented is for informational purposes and is not intended arsenic concern advice.

5 months ago

104

5 months ago

104

English (US)

English (US)