Singapore, Singapore, April 10th, 2024, Chainwire

On April 4th, Binance Web3 Wallet joined forces with BEVM, a starring Bitcoin Layer2, and its ecosystem project, Satoshi Protocol, to motorboat an airdrop run worthy millions.

Users who span BTC to the BEVM via Binance Web3 Wallet and get astatine slightest $10 SAT (USD-stablecoin) volition beryllium eligible to stock a excavation of 500k OSHI and 10.5 cardinal BEVM tokens. The run has attracted implicit 30,000 participants successful conscionable 3 days since its launch.

Satoshi Protocol is the archetypal CDP protocol built connected BEVM, unrecorded connected BEVM mainnet connected March 28th. In summation to the Binance campaign, there's a referral programme that allows aboriginal participants to accumulate points by borrowing the SAT and inviting friends.

What Makes BEVM Unique?

BEVM is an EVM-compatible Bitcoin Layer 2 solution that stands retired successful the crowded market. By leveraging Taproot consensus, Schnorr signatures, MAST, and Bitcoin SPV, BEVM achieves the highest level of decentralization and information among each BTC Layer 2 solutions.

Key features of BEVM:

- Native BTC Layer 2: BEVM utilizes BTC arsenic the web state and stores transaction information connected the BTC mainnet, ensuring compatibility with the archetypal Bitcoin protocol.

- EVM compatibility: Developers tin seamlessly migrate their Ethereum-based dApps to BEVM, expanding the scope of these applications to the Bitcoin ecosystem.

- Decentralized and secure: BEVM employs Musig2 multi-signature aggregation and Bitcoin airy nodes to execute a trustless and unafraid environment.

Satoshi Protocol: Unleashing Bitcoin's Liquidity

Satoshi Protocol is the archetypal Collateralized Debt Position (CDP) protocol built connected BEVM, aiming astatine providing liquidity for BTC done the SAT dollar stablecoin, expanding the scenarios of BTCFi. This determination unlocks trillion-dollar liquidity wrong the Bitcoin ecosystem, offering users a mode to support Bitcoin holdings portion gaining liquidity.

The Bitcoin ecosystem is experiencing a renaissance. Recent advancements similar inscriptions and scaling solutions person revitalized the ecosystem. Satoshi Protocol's squad views the upcoming halving and the motorboat of the Runes protocol arsenic poised to pull a question of caller users.

However, a captious situation persists the deficiency of a reliable, fiat-pegged crypto for seamless trading and businesslike marketplace pricing. This is wherever Satoshi Protocol steps in. By enabling users to get SAT with their Bitcoin arsenic collateral, Satoshi Protocol offers a reliable liquidity solution wrong the Bitcoin ecosystem.

Satoshi Protocol Milestones

In the past month, Satoshi Protocol has built a beardown community, with 60,000+ followers on Twitter and 70,000+ members across Telegram and Discord.

Let’s spot what they person achieved :

- February 24th: Satoshi Protocol launched connected BEVM testnet.

- March 18th: Testnet concluded with 100,000+ participants and 80,000+ NFT minted.

- March 24th: Smart contracts passed information audits by Scalebit and Supremacy.

- March 26th: Pre-seed funding secured from Web3Port Foundation, Waterdrip Capital and BEVM Foundation.

- March 28th: Launched connected BEVM Mainnet.

- April 4th: 500k OSHI Airdrop with BEVM connected Binance wallet.

How does Satoshi Protocol work?

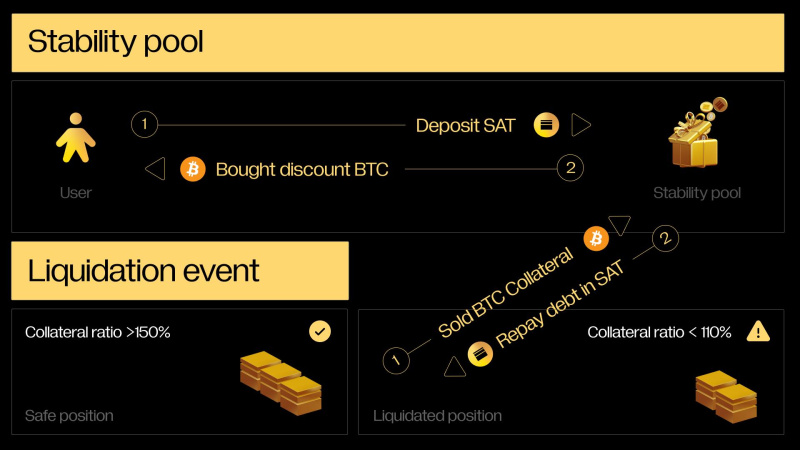

The Satoshi Protocol utilizes a blase strategy to support a unchangeable peg of $1 for SAT. This strategy combines respective mechanisms: over-collateralization, permissionless liquidation, stableness pools, and arbitrage. Additionally, it features OSHI, a inferior token granting holders 97.5% of the protocol's revenue.

For much details astir OSHI and sOSHI, notation to the authoritative documentation: OSHI & sOSHI.

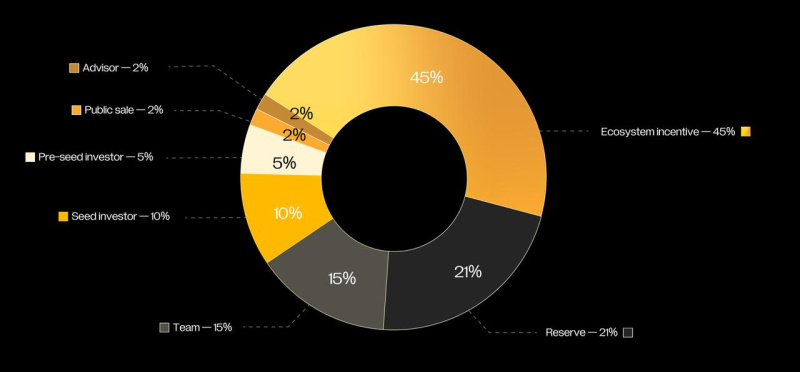

OSHI distribution

The interplay betwixt SAT and OSHI forms the bosom of Satoshi Protocol. Here's the implicit picture:

Collateralized Borrowing

When borrowing SAT, users indispensable support a minimum collateral ratio (MCR) of 110%. This means the borrowed magnitude cannot transcend 90.9% of the deposited BTC value.

Liquidation

A liquidation is triggered if a user's collateral worth dips beneath 110% (MCR) owed to terms fluctuations. The user's BTC collateral is sold astatine a discount to Stability Pool providers to repay the SAT loan. This mechanics protects the protocol and prevents borrowers from taking connected excessive debt.

Maintaining the Peg

A robust three-pronged strategy ensures SAT's worth remains consistently pegged to the US dollar:

Redemption: Arbitrage enactment helps modulate SAT's terms and support it wrong the desired range. If SAT dips beneath $1, arbitrageurs tin bargain discounted SAT and redeem them for $1 worthy of BTC from the protocol. Conversely, if SAT exceeds $1.1, users tin get SAT astatine the MCR (110%), merchantability them astatine a premium connected decentralized exchanges (DEXs), and pouch the profit.

Over-collateralization: As mentioned earlier, over-collateralization (MCR of 110%) acts arsenic a information net. The protocol discourages borrowers from defaulting by requiring a higher collateral worth and protects itself from terms fluctuations.

Stability Pool: This excavation serves arsenic a last information measure. If a user's collateral ratio falls beneath the MCR, the Stability Pool provides the indispensable liquidity to execute a liquidation lawsuit and support protocol stability.

Satoshi Protocol x BEVM Airdrop with Binance wallet

BEVM and Satoshi Protocol precocious joined forces with Binance Web3 Wallet to connection a full of 10.5M $BEVM and 500k $OSHI Token Airdrop.

By utilizing Binance Wallet to implicit tasks similar span to BEVM, and make positions connected Satoshi Protocol, you'll beryllium eligible to stock the rewards.

Duration: 2024/04/04-2024/05/04

Rewards: 10,500,000 BEVM and 500,000 OHSI

Tasks:

- Using Binance Wallet

- Bridge BTC to the BEVM ( 0.0004 BTC, ~$25)

- Create positions connected Satoshi Protocol ( astatine slightest 10 SAT )

Join Binance Wallet Airdrop Campaign

How to Participate successful this Campaign

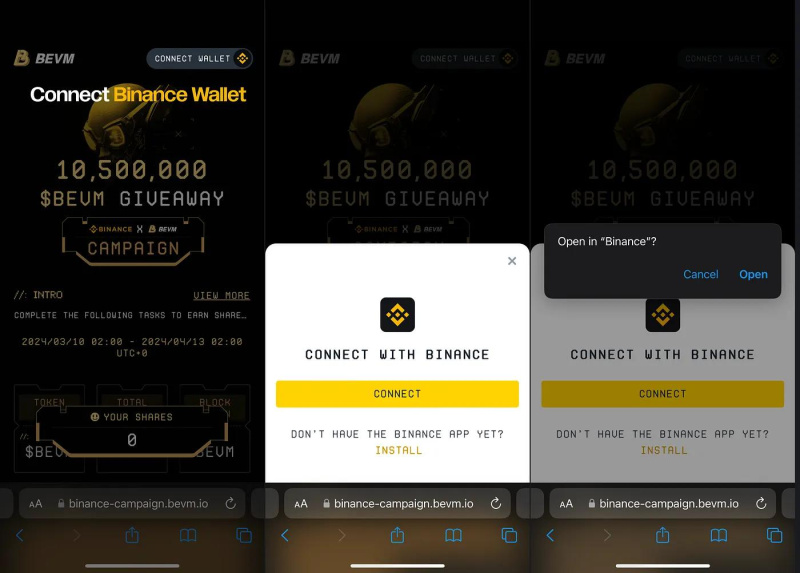

STEP 1: Users should spell to Campaign Landing Page, and link Binance Wallet

STEP 2: Withdraw BTC and span to BEVM

- Suggest withdrawing astatine slightest 0.0004 BTC to implicit the task

- Using OmniBTC to transportation BTC from BSC to BEVM

- Using BEVM span to transportation BTC from mainnet to BEVM ( ~ 30mins )

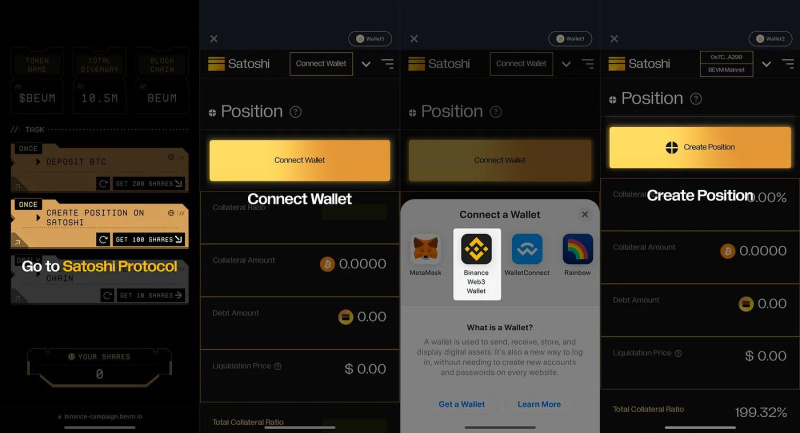

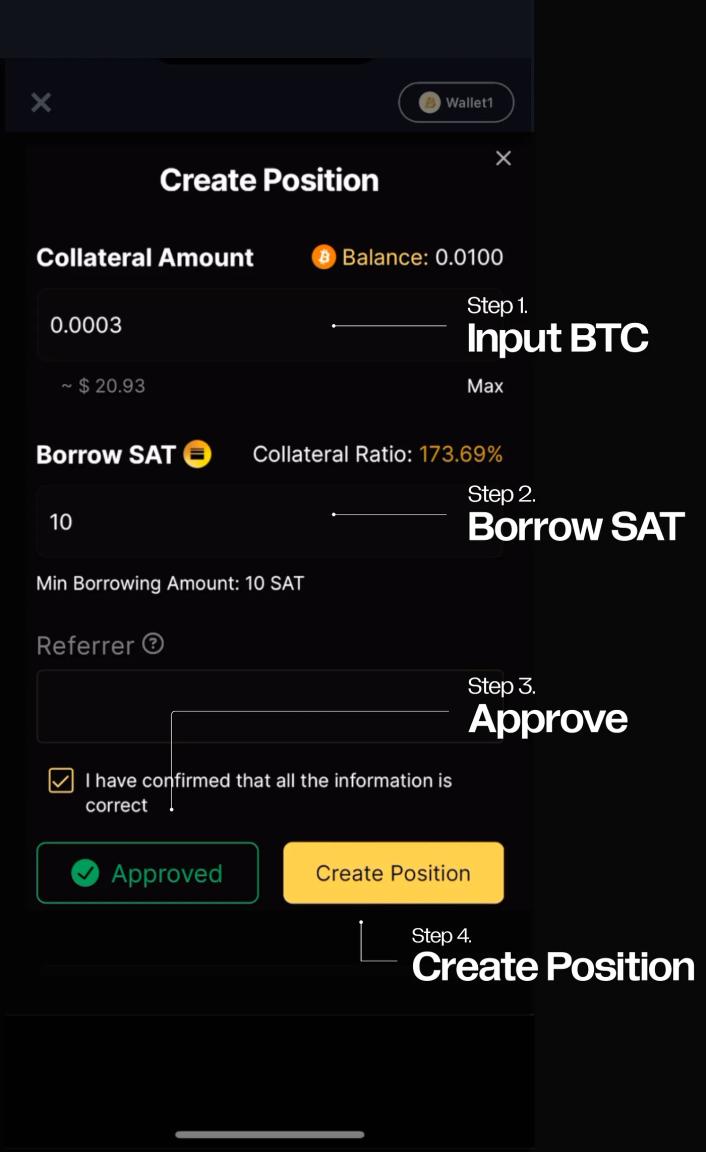

STEP 3: Users should spell to Satoshi Protocol, and make Position

Users should spell to Satoshi Protocol, and Connect Wallet

- Input BTC Amount

- Borrow SAT ( astatine slightest 10 SAT )

- (Optional) Fill successful your referrer, get 150+ points

- Click "Approve"

- Click “Create Position”

Binance Wallet Mobile tutorial: Create Position Using Binance Web3 Wallet

Upon completing each those steps, the idiosyncratic becomes qualified for the BEVM and OSHI airdrop!

Bridging the Future: Satoshi Protocol and Binance Wallet's Airdrop Campaign

Satoshi Protocol represents a glimpse into the aboriginal of Bitcoin finance. By leveraging the BEVM and a robust CDP model, it allows users to get BTC-backed stablecoin SAT and grow the anticipation for Bitcoin Ecosystem.

Binance Wallet launched an airdrop run with a full of 10.5M $BEVM, 500K $OSHI for those who span BTC to BEVM and make positions connected Satoshi Protocol, which is besides Binance Wallet's archetypal integration with a Bitcoin Layer 2 solution. BTCFi is heading west.

About Satoshi Protocol

Built connected BEVM, it's the archetypal CDP protocol to unlock the existent imaginable of Bitcoin. Unleash unprecedented liquidity done SAT, a stablecoin designed to supercharge the booming BTCFi market.

To larn astir Satoshi Protocol, users tin follow:

Website | Web APP | Twitter | Telegram | Discord | Docs | Blog

Contact

Marketing

Hugo

Satoshi Protocol

[email protected]

English (US)

English (US)