Hello,

A idiosyncratic update to footwear disconnected the year: I’ve joined Powerhouse, an ecosystem histrion for MakerDAO that is gathering an AI-enabled DAO operating strategy and plug-in store. Governance and DeFi stay some halfway interests for me, and I’m excited astir returning to the DAO satellite and gathering for MakerDAO. I’ll proceed to probe connected MEV, lending and the remainder of DeFi but beryllium connected the lookout for much governance-related content. And if you’re astatine ETH Denver oregon gathering successful DAOs, get successful touch.

- Chris

This contented of Dose of DeFi is brought to you by:

No request to unfastened up 5 tabs to marque an informed trade. Oku has precocious analytics, bounds orders, and TradingView charts, each successful 1 spot for the champion DEX experience. Website & Twitter

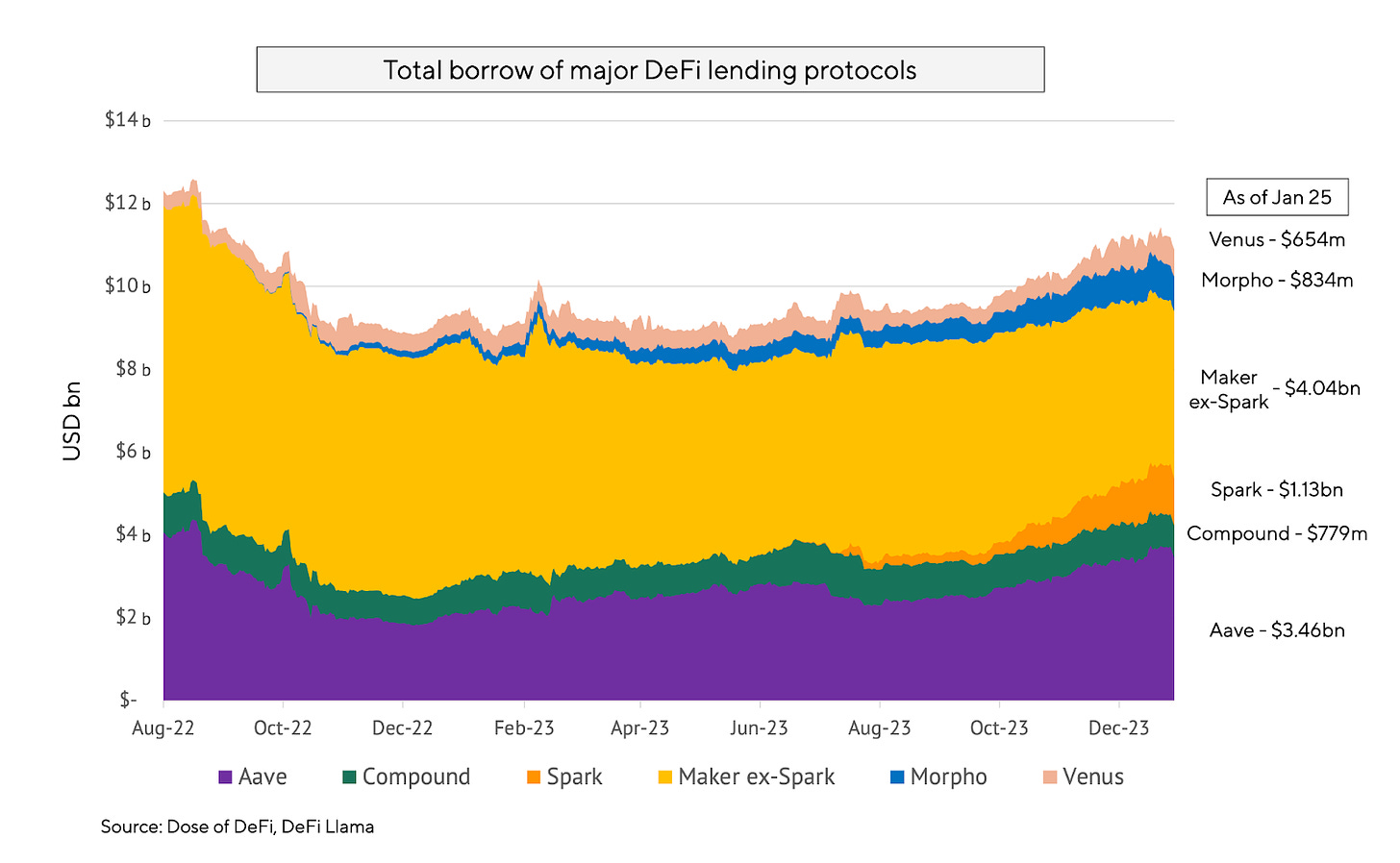

DeFi lenders came retired of the marketplace carnage of 2022 bruised but inactive functioning (which could not beryllium said for their CeFi brethren). Just arsenic crypto markets were crashing and request for leverage was plummeting, the Fed added to DeFi lenders’ symptom via its astir assertive rate-hiking run ever, sapping request for the humble yields successful DeFi. And past successful March 2023, the autumn of SVB and the depegging of USDC threatened to propulsion each lending protocols underwater.

A twelvemonth aboriginal and that fearfulness has disappeared; DeFi lenders are flourishing. On-chain rates present look much similar those successful TradFi (thanks to immoderate nudging from Maker), and a full caller harvest of innovative products person broadened collateral basal and diversified the hazard offerings – thing that’s surely acceptable to continue.

While DeFi trading collectively struggles to connection a merchandise much competitory than CeFi, DeFi lending has already surpassed CeFi and offers much imaginable to turn into mainstream markets with higher yields. Thanks to higher rates, DeFi lending protocols are seeing an detonation of on-chain gross that volition beryllium reinvested backmost into enlargement into caller markets. We don’t expect a bull marketplace sweetener high, but alternatively a displacement distant from the DeFi of the zero involvement complaint situation toward a caller play of higher gross and broader appeal.

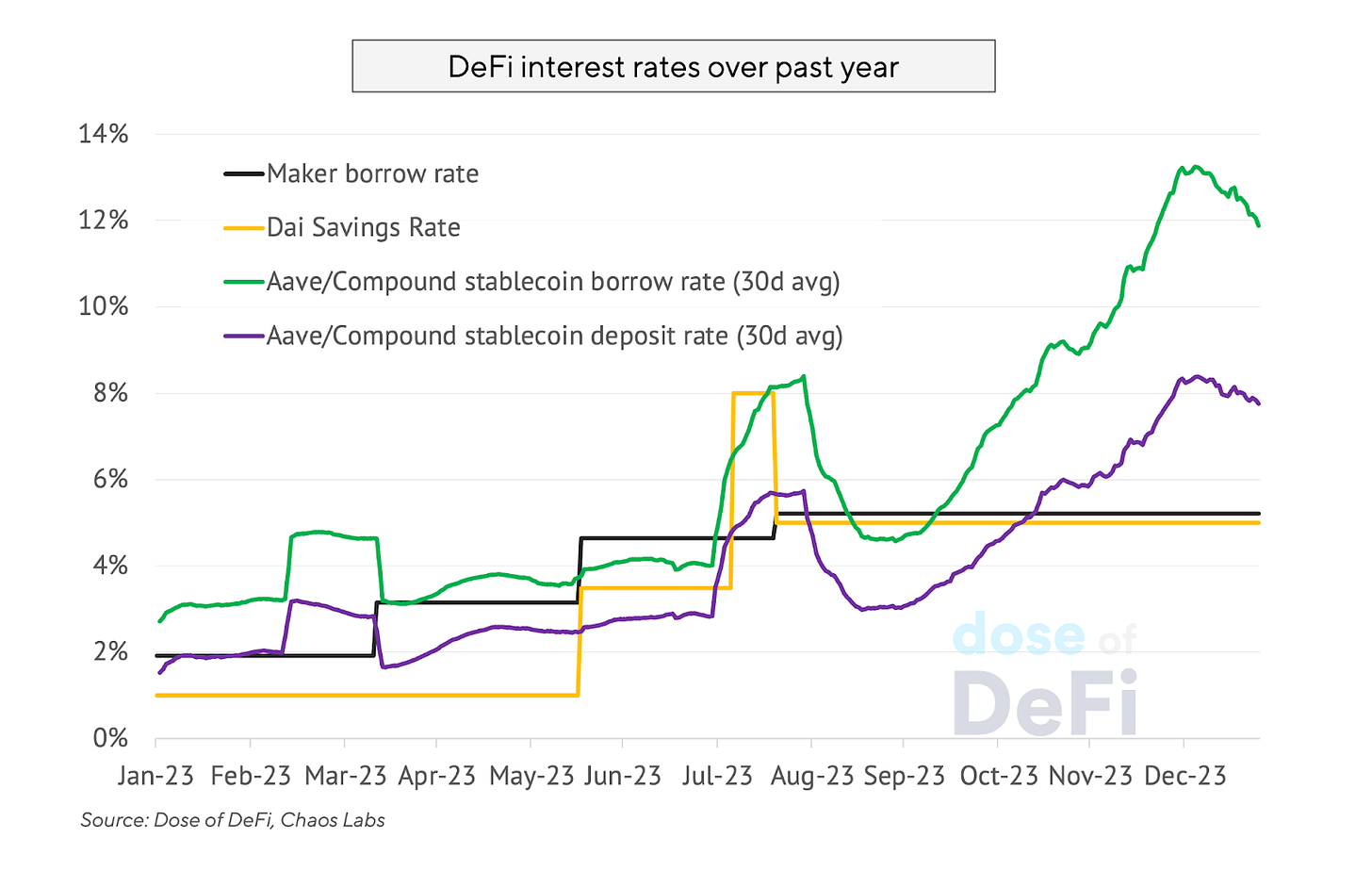

Rates climbed steadily passim 2023, driven by 2 forces: the accrued request for leverage arsenic markets heated up, and real-world output coming on-chain. MakerDAO led the complaint with higher rates erstwhile it voted to summation the borrowing complaint for its vaults successful the spring, adjacent though request for borrowing was tepid. Unlike Compound and Aave – wherever involvement rates are acceptable by marketplace request – Maker has afloat power implicit what involvement complaint it issues for Dai loans.

Maker was not raising rates conscionable to instrumentality it to borrowers. Higher lending rates allowed it to rise the Dai Savings Rate, archetypal to 3.33%, and aboriginal to 5% (where it remains for now).

The maturation of existent World assets (RWA) successful MakerDAO brought higher TradFi rates to DeFi and greatly reduced their stablecoin exposure. Dai was sometimes derisively mocked arsenic “wrapped USDC”, but this is nary longer the case. At the opening of 2023, 63% of Dai was backed by USDC oregon different stablecoin. Fast guardant to today, and that fig is 12%. It has been replaced by real-world assets (primarily T-bills), which are yielding 5%+. This involves a batch of off-chain complexity swapping USDC successful the Peg Stability Module for T-bills and dripping payments backmost to the protocol successful Dai, but it scales amended than crypto collateral.

Throughout 2023, Maker has maintained its pb successful the ETH lending marketplace up of Aave. In 2021, Aave benefited from an assertive collateral onboarding strategy. This played retired good for them successful the modulation to staked ETH, and their aboriginal mover vantage enabled them to fastener successful the liquidity web effects. It has much staked ETH than Maker. Staked ETH represents 59% of Aave’s ETH-based collateral, compared with 42% for Maker. Compound missed retired connected the staked ETH market, but remains a competitory 2nd spot (behind Aave) successful WBTC.

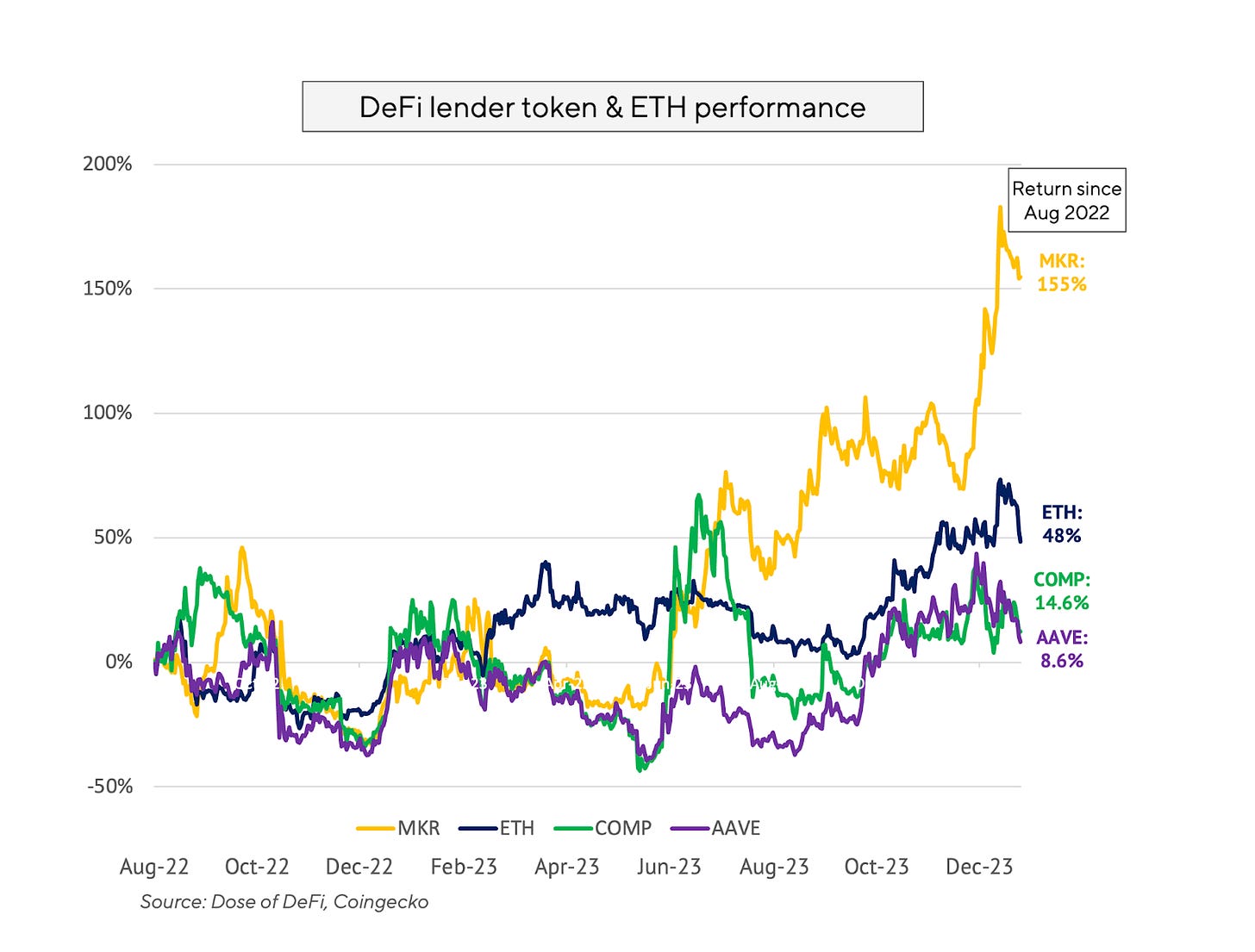

MKR has led successful token performance. Its standout growth, however, occurred implicit the past fewer months, connected higher revenues from RWAs and speculation astir changes successful the Endgame (more connected that later).

The adjacent competitory dynamics betwixt Maker, Aave, and Compound (and different smaller players) has helped thrust a question of continued innovation and caller merchandise releases successful lending. This involves some caller and aged players alike. The astir breathtaking caller developments are arsenic follows:

Morpho launched successful August 2022, and present has a mates of antithetic products. The Optimizer is simply a P2P lending protocol built connected apical of Compound and Aave. It matches up lenders and borrowers straight and falls backmost connected Compound oregon Aave. Just this month, Morpho released Morpho Blue, a protocol with a precise bladed furniture of governance and off-chain dependencies. Instead of relying connected halfway protocol governance to negociate lending risks. Morpho Blue is permissionless astatine the basal layer, but lending pools tin beryllium curated by DeFi work providers similar Block Analitica, Steakhouse, oregon B. Protocol. It besides offers higher loan-to-value (LTV) ratios owed to enhanced superior efficiency.

Ajna just launched this month. It’s adjacent much governance-minimized than Morpho and besides boasts a non-oracle design, arsenic good arsenic being capable to judge immoderate ERC20 oregon NFT arsenic collateral. It uses an interior bid publication for lending positions, meaning users sets a marketplace terms for what their collateral could lick for. Ajna could beryllium thought of arsenic an “interest-bearing bounds bid connected the borrowed asset”. It’s not precise normie friendly, but its flexibility means that others mightiness physique primitives connected apical of Ajna to marque it easier to entree for little blase users.

GHO & crvUSD are caller stablecoins from Aave and Curve respectively. GHO remains tiny (market cap: $35m) and has struggled with peg management. It’s inactive aboriginal days though, and fixed Aave’s presumption successful the lending market, it tin instrumentality its clip gathering up an ecosystem astir GHO. Presumably, Aave is funny successful replicating the RWA exemplary that Maker has pioneered. That’s not the lawsuit for crvUSD. Its strategical vantage is that it makes LPing connected Curve much attractive, and there’s immoderate reflexivity to it arsenic a stablecoin hub. Its cardinal innovation its dilatory liquidations. They conscionable announced further lending plans this week with codification already up connected github.

Spark is simply a fork of Aave v3 that was launched arsenic a subDAO of MakerDAO. It is plugged into Maker halfway done the Direct Deposit Module (D3M). Unlike Compound v2 oregon Aave, the Maker Protocol is not a wealth marketplace and does not lend retired collateral (it uses the CDP model). Spark is simply a mode of offering this merchandise portion inactive connected to Maker’s equilibrium sheet. Spark’s Dai get complaint is acceptable by MakerDAO governance (currently 5.53%). It offers the champion borrowing rates due to the fact that it’s not babelike connected its proviso of Dai deposits. It tin simply mint caller Dai. Spark is conscionable the opening of immoderate large changes to MakerDAO that revolve astir the ambitious Endgame plan. For example, Spark volition beryllium 1 of respective “subDAOs” that tin get connected Maker’s equilibrium sheet. These subDAOs volition person caller tokens to beryllium farmed out, starting this year. Maker is besides getting a implicit rebrand and a caller token. The farming and rebrand should bring overmuch needed attraction to DeFi.

Additionally, lending protocols person seen significant maturation successful deposits and borrowing connected their L2 deployments. Token emissions are a large crushed for this, but the assets are apt to enactment aft incentives arsenic involvement rates connected L2s are besides comparatively competitory with Ethereum. L2s and low-cost chains are precise important for DeFi lenders’ expansion, arsenic it’s the lone mode they tin determination towards a much wide retail capitalist base.

In DeFi, marketplace dynamics are much fluid successful lending, and occurrence seems much babelike connected catching the latest question of capitalist preference. Compound’s aboriginal occurrence was owed to COMP farming, which kicked disconnected a question of copycats. Aave pulled up due to the fact that it cornered the LST market.

Looking ahead, lending protocols volition adjacent beryllium battling to pull the upcoming onslaught of restaked ETH tokens expected to deed the marketplace with the motorboat of Eigenlayer. We discussed the “ETF-ization of ETH yield” past twelvemonth and since then, respective projects specified arsenic Rio, Renzo, and Swell, person already announced plans to motorboat caller forms of tokenized restaked ETH. This volition beryllium trickier than staked ETH, wherever determination are antithetic tokens for the aforesaid output (ETH rewards from the Ethereum protocol). With restaked LSTs, determination volition beryllium scores of antithetic types of output with antithetic hazard considerations. The marketplace volition apt beryllium much splintered than vanilla staked ETH, wherever Lido has 70%+ marketplace share. Most absorbing volition beryllium to spot however conducive lending protocols are to highly-leveraged recursive borrowing, fixed that the plus prices of the restaked LSTs volition beryllium highly correlated, adjacent if their hazard is not.

Yield is simply a almighty motivator for investors. For the crypto-curious, DeFi’s precocious rates tin beryllium casual to constitute disconnected arsenic coming from “fake governance tokens”. But output tin besides beryllium pure, arsenic demonstrated by the entreaty of 5% hazard escaped successful TradFi past year. DeFi lenders could beryllium the cardinal to onboarding much casual DeFi users if they tin connection sustainable yield. A important magnitude of superior could travel from CeFi crypto users alone, if yields are attractive.

The astir promising facet of DeFi lenders is that they’re making money. MakerDAO could scope $200m successful gross this year, with expenses nether $30m. Aave, meanwhile, whitethorn spot $35m successful yearly revenue, portion Compound could surpass $15m. These are going to the DAOs and tin beryllium reinvested into maturation and protocol development. Allocating that superior to entities that are aligned connected a strategy and ngo volition necessitate effectual and businesslike governance. Lending protocols person professionalized their hazard absorption done work providers similar Gauntlet, Block Analitica, and Chaos Labs, but they’ll request to widen this absorption to different governance areas going forward. Lending protocols are analyzable and necessitate coordination, but the past fewer years person proven that the exemplary genuinely tin standard and beryllium a sustainable concern model.

Bloxroute merchandise to assistance validators navigate statement timing games Link

What it takes to beryllium a artifact builder Link

Flash marketplace making MEV protocol Aori launches connected Arbitrum Link

Paypal participates successful CRV bribe governance for its stablecoin Link

Khlani Network aims to beryllium decentralized solver infrastructure furniture Link

Orderflow.art Link

Optimism RetroPGF Round 3 recipients Link

Synthetix launches v3 perpetuals connected Base Link

Crypto's Three Body Problem [Toby Shorin, Laura Lotti, Sam Hart/Other Internet]

Loss versus Rebalancing 101 [Alphaist/Titatnia]

Evolution of the artifact gathering crippled [Danning/Flashbots]

A way for sustainable relay incentivization [ballsyalchemist/Fenbushi]

Auctions: context, types of auctions, what is an auction from the Auction Theory Perspective and from the Mechanism Design Perspective, and EIP-1559 arsenic a circumstantial illustration [Taiko Labs]

Spark Protocol: An overview [AXSN]

Tether’s Ascent: Breaking down the ascendant stablecoin's maturation [Tanay Ved/CoinMetrics]

That’s it! Feedback appreciated. Just deed reply. Written successful Nashville, wherever I’m inactive recovering from our large snowfall past week.

Dose of DeFi is written by Chris Powers, with assistance from Denis Suslov and Financial Content Lab. I walk astir of my clip contributing to Powerhouse, an ecosystem histrion for MakerDAO. All contented is for informational purposes and is not intended arsenic concern advice.

3 months ago

103

3 months ago

103

English (US)

English (US)